- Save at least 10% of all that you earn for an investment fund for the future

- Learn to live on 90% or less of your income

- Invest your accumulated capital into projects that will provide a safe, steady income, taking full advantage of compounding of the interest received

- Invest only in areas in which you have expertise or with people who are experienced

- Buy the house in which you live so you don’t waste any money on rent

- Have a realistic insurance program

- Always keep working at various ways and means of increasing your income

- Track your wealth

What I got out of it

- This should be a mandatory read for every middle schooler. Simple wealth management advice that if learned early can have tremendous implications for the rest of your life. Will be one of the books I give away most to others

1. Pay Ourselves First (“Start thy purse to fattening.”)

3. Make our money work for us (“Make thy gold multiply”)

4. Insurance protects our wealth (“Guard they treasures from loss.”)

6. Have a retirement plan (“Insure a future income.”)

- When Bansir and Kobbi seeked the advice of their very wealthy friend Arkad he tells them a story. Arkad was once a poor scribe who made a deal with a rich man to find out the secret to wealth in exchange for his work on a clay inscription. The rich man gave him a very valuable advice ”I found the road to wealth,” he said, “When I decided that a part of all I earned was mine to keep. And so will you.” Although this is a very subtle message it is very powerful in accumulating wealth. We cannot accumulate wealth if we do not save what we earned. We can do that by paying ourselves first and foremost before we spend any of the money we have earned.

- Pay yourself 10% of what you earn

- If we have paid ourselves first at least 10% of what we earn that leaves us with 90% or less of our income to live on. Controlling our expenditures enable us to make good use of the money we have left over after we have paid ourselves. There have been many advice on frugality over the years but I think it will not solve the problem for the majority of us until we truly define what money is to us and also define the difference of need vs. want

- “Budget your expenses so that you may have money to pay for your necessities, to pay for your enjoyments and to gratify your worthwhile desires without spending more than nine-tenths of your earnings.”

- The best advice to becoming wealthy is to keep expenditures down even when our earning power increases.

- Controlling expenditures will mean living below our means. When we live below our means we accumulate wealth faster. We can think of it in this way, our earning power is our ‘offense’ and controlling our expenditures is our greatest ‘defense’.

- After we have accumulated 6-8 months worth of expenses in our Emergency Fund it is only then that we should consider about investing our money on other investment vehicles. Our Emergency Fund is a security blanket especially during this time of economic downturns.

- ” …put each coin to work so that it may reproduce its kind even as the flocks of the field and help bring to you more income, a stream of wealth that will flow constantly into your purse.”

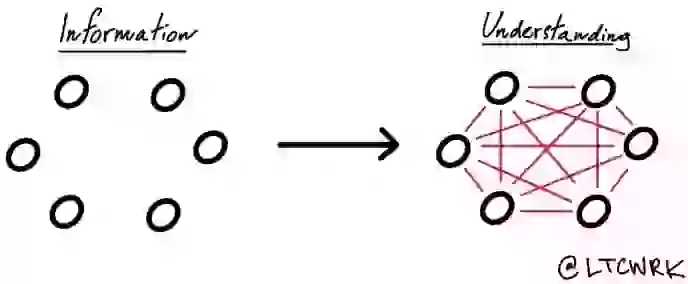

- There are many investment vehicles we can tackle but the best thing we should all be aware of is that we should never invest in anything we do not completely understand

- Investing our money will mean becoming knowledgeable about what we are investing in as well as the repercussions if the investment does not pan out as well as our potential exit strategies when we are ready to take our money out. There are many ways we can invest our money such as stock markets, real estate, businesses, and so on

- We should also invest our money to ensure we have a steady and safe income while taking advantage of compounding interest we receive from our investments

- Time is our biggest ally and as our investment accumulate interest and the money we get from the interest earns interest and so on this is how we can make our gold multiply.

- We should all consider buying insurance now in case we need it if something happens. This is a proactive approach and one we should take and not forget. The idea is that we will never have to use the insurance but in case something does happen we are protected financially from the loss it would have caused.

- Our homes are potentially the biggest expense we have to tackle. Many of us do not own a home and instead rent one. There is absolutely nothing wrong with that but I believe the lesson we can learn from this one is that we should manage our biggest expense smartly. Many of us have decided to take on a huge mortgage to buy our home and after the real estate bust many were left with homes that lost their value and in many cases were underwater. I believe the lesson we can learn from that was that we needed to ‘live below our means’ and buy or rent a home we can comfortably afford.

- When we start putting money away for retirement early we take advantage of a magical thing called ‘compounding interest‘.

- Our net-worth does not equal our self-worth. We need to keep them separated.

- “Remember that money is of a prolific generating nature. Money can beget money, and its offspring can beget more.” – Benjamin Franklin

- The best way we can increase our earning is by investing in ourselves. We can do that by continually learning and striving to develop ourselves.

- OpenCourseware idea where many schools including Ivy Leagues post their whole class courses for free. It’s a great way to learn on our own. Another one is Coursera which has many online courses for free from Finance to Philosophy, check it out.

- “Those eager to grasp opportunities for their betterment, do attract the interest of the goddess of fortune. She is ever anxious to help those who please her. And who is she pleased with? She is pleased with those who do - rather than those who merely talk and engage in wishful thinking. Action will lead you forth to the successes you desire.”

- In order for us to know where we stand financially we need to face the whole truth of our current situation. We can do that by tracking our current wealth or lack thereof.