- Contrarian that I am, the format for this book is intentionally unorthodox as books on investing go these days. It is not about Hail Mary passes; it's about grinding out gains quarter after quarter, year after year. My kind of investing rests on three elements: character, goals, and experience. With patience, luck, and sound judgment, meanwhile, you keep moving forward. That's the nature of the investment game: now and then a windfall, but mostly a four-yard gain and a cloud of dust. tilt investment style can give investors a lucrative edge over the long haul. But if you can't roll with the hits, or you're in too big a hurry, you might as well keep your money in a mattress.

- Windsor's roller coaster experience with Citi underscored a crucial point: investment success does not require glamour stocks or bull markets. Judgment and fortitude were our prerequisites. Judgment singles out opportunities, fortitude enables you to live with them while the rest of the world scrambles in another direction. Citi exemplified this investment

- Shortcuts usually grease the rails to disappointing outcomes.

- One time, we delivered a compressor to Tecumseh Products in Tecumseh, Michigan. We got top dollar because they needed it right away.Working for my father at least taught me that you don't need glamour to make a buck. Indeed, if you can find a dull business that makes money, it is less likely to attract competition.

- The Navy paid us every two weeks, and the first night after payday six or seven poker games sprang up. By the following night, there were only one or two poker games. Much like money in the stock market, poker money migrated to the most proficient and well financed players, a group that usually included me. Observing occasionally, I noted how sailors who ultimately went home with cash in their pockets played consistently and with good knowledge of the odds. They were not lured into action for big pots unless the numbers were on their side. If those sailors applied the same philosophy to stocks, some of them are successful investors today.

- In classic fashion, frantic efforts to correct the underperformance only compounded Windsor's plight. Windsor had succumbed to infatuation with small supposed growth companies without sufficient attention to the durability of growth. Then, as now, I assigned great weight to a judgment about the durability of earnings power under adverse circumstances.

- I'd seen enough hitting behind the ball. By playing it safe, you can make a portfolio so pablum-like that you don't get any sizzle. You can diversify yourself into mediocrity. This sounds like heresy to many advocates of modern portfolio theory, but sticking our neck out worked for Windsor.

- Brain surgery it's not, but I've always found that investors who skip elementary steps stumble sooner rather than later.

- Windsor was never fancy, fad-driven, or resigned to market performance. We followed one durable investment style whether the market was up, down, or indifferent. These were its principal elements:• Low price-earnings (p/e) ratio.• Fundamental growth in excess of 7 percent.• Yield protection (and enhancement, in most cases).• Superior relationship of total return to p/e paid.• No cyclical exposure without compensating p/e multiple.• Solid companies in growing fields.• Strong fundamental case.In a business with no guarantees, we banked on investments that consistently gave Windsor the better part of the odds. It wasn't always a smooth ride; at times, we took our lumps. But, over the long haul, Windsor finished well ahead of the pack.

- Windsor was not fancy. As in tennis, I tried to keep the ball in play and let my adversaries make mistakes. I picked stocks with low p/e multiples primed to be upgraded in the market if they were deserving, and endeavored to keep losers at break-even levels. Usually, I returned home with more assets in the Windsor Fund than the day before. And I slept well-and still do.

- Low p/e companies growing faster than 7 percent a year tipped us off to underappreciated signs of life, particularly if accompanied by an attention-getting dividend.

- No solitary measure or pair of measures should govern a decision to buy a stock. You need to probe a whole raft of numbers and facts, searching for confirmation or contradiction.

- Judgment lies in recognizing which way the fundamentals point. Conventional wisdom and preconceived notions are stumbling blocks as well as signs of opportunity.

- You can sum up the Street's psychology this way: Hope for the best, expect the worst. Meantime, don't stick your neck out.

- Dramatic actions taken by companies, as opposed to broad challenges posed by difficult industrial or economic climates, can trigger unwarranted selling pressure.

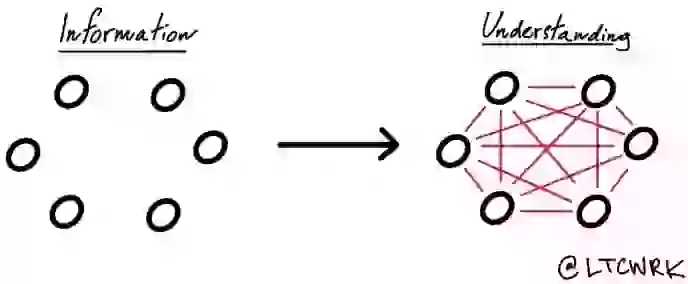

- Investing is not a very complicated business; people just make it complicated. You have to learn to go from the general to the particular in a logical, sequential, rational manner.

- Refusal to partake in groupthink caused us to underperform the market by 9.8 percentage points in 1980 but cascaded to Windsor's benefit in 1981. We recovered our footing and surpassed the S&P 500 by better than 21.7 percentage points. We'd pinned our reputation to a rout of that sort.

- Windsor did not achieve superior results by going against the grain at every chance. Stubborn, knee-jerk contrarians follow a recipe for catastrophe. Savvy contrarians keep their minds open, leavened by a sense of history and a sense of humor.

- Measured Participation established four broad investment categories:1. Highly recognized growth.2. Less recognized growth.3. Moderate growth.4. Cyclical growth.Windsor participated in each of these categories, irrespective of industry concentrations. When the best values were available in, say, the moderate growth area, we concentrated our investments there. If financial service providers offered the best values in the moderate growth area, we concentrated in financial services. This structure enabled us to flout the constraints that usually condemn mutual funds to ho-hum performance.

- The debate over top-down versus bottom-up investing has always seemed a little fuzzy to Inc. I just keep an eve on the economy and ask, where is a sector that's overdue for recognition

- Many investors can't bear to part company with a stock on the way up, lest they miss the best gain by not holding on. They persuade themselves that a day after they sell, they will have short-changed themselves by not capturing the penultimate dollar. My attitude is: I'm not that smart.

- When you feel like bragging about a stock, it's probably time to sell.

- Conventional wisdom suggests that, for investors, more information these days is a blessing and more competition is a curse. I'd say the opposite is true. Coping with so much information runs the risk of distracting attention from the few variables that really matter. Because sound evaluations call for assembling information in a logical and careful manner, my odds improve, thanks to proliferating numbers of traders motivated by tips and superficial knowledge. By failing to perform rigorous, fundamental analyses of companies, industries, or economic trends, these investors become prospectors who only chase gold where everyone else is already looking.

- At least a portion of Windsor's critical edge amounted to nothing more mysterious than remembering lessons of the past and how they tend to repeat themselves. You cannot become a captive of historical parallel, but you must be a student of history.

- As the market grew more excited, we grew more cautious.

- I wasn't uncomfortable going into retirement. I had given Windsor my all. I was going out while I still had a lot left, which had been my intention.

What I got out of it

- Entertaining book, simple language, some important takeaways. Take a simple idea, and take it seriously