- Introduction

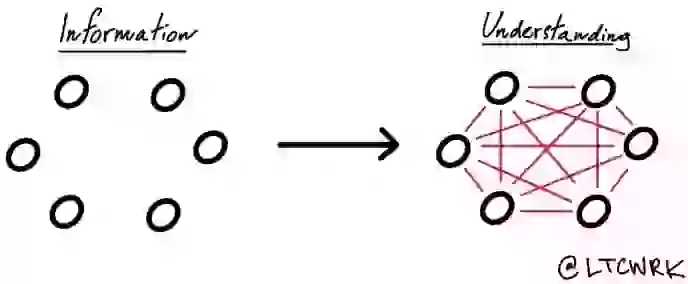

- Ideally this will be considered, not a book about investing, but a book about thinking about investing. Like most eighth-grade algebra students, some investors memorize a few formulas or rules and superficially appear competent but do not really understand what they are doing. To achieve long-term success over many financial market and economic cycles, observing a few rules is not enough. Too many things change too quickly in the investment world for that approach to succeed. It is necessary instead to understand the rationale behind the rules in order to appreciate why they work when they do and don't when they don't. I could simply assert that value investing works, but I hope to show you why it works and why most other approaches do not.

- The temptation of making a fast buck is great, and many investors find it difficult to fight the crowd.

- Regardless of the market environment, many investors seek a formula for success. The unfortunate reality is that investment success cannot be captured in a mathematical equation or a computer program.

- Ultimately investors must choose sides. One side—the wrong choice—is a seemingly effortless path that offers the comfort of consensus. This course involves succumbing to the forces that guide most market participants, emotional responses dictated by greed and fear and a short-term orientation emanating from the relative-performance derby. Investors following this road increasingly think of stocks like sowbellies, as commodities to be bought and sold. This ultimately requires investors to spend their time guessing what other market participants may do and then trying to do it first. The problem is that the exciting possibility of high near-term returns from playing the stocks-as-pieces-of-paper-that-you-trade game blinds investors to its foolishness. The correct choice for investors is obvious but requires a level of commitment most are unwilling to make. This choice is known as fundamental analysis, whereby stocks are regarded as fractional ownership of the underlying businesses that they represent. One form of fundamental analysis—and the strategy that I recommend—is an investment approach known as value investing. There is nothing esoteric about value investing. It is simply the process of determining the value underlying a security and then buying it at a considerable discount from that value. It is really that simple. The greatest challenge is maintaining the requisite patience and discipline to buy only when prices are attractive and to sell when they are not, avoiding the short-term performance frenzy that engulfs most market participants. The focus of most investors differs from that of value investors. Most investors are primarily oriented toward return, how much they can make, and pay little attention to risk, how much they can lose.

- The value discipline seems simple enough but is apparently a difficult one for most investors to grasp or adhere to. As Buffett has often observed, value investing is not a concept that can be learned and applied gradually over time. It is either absorbed and adopted at once, or it is never truly learned.

- Where Most Investors Stumble

- Mark Twain said that there are two times in a man's life when he should not speculate: when he can't afford it and when he can. Because this is so, understanding the difference between investment and speculation is the first step in achieving investment success.

- Investors believe that over the long run security prices tend to reflect fundamental developments involving the underlying businesses

- Investors in a stock thus expect to profit in at least one of three possible ways: from free cash flow generated by the underlying business, which eventually will be reflected in a higher share price or distributed as dividends; from an increase in the multiple that investors are willing to pay for the underlying business as reflected in a higher share price; or by a narrowing of the gap between share price and underlying business value.

- In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a speculative undertaking.

- The distinction is not clear to most people. Both investments and speculations can be bought and sold. Both typically fluctuate in price and can thus appear to generate investment returns. But there is one critical difference: investments throw off cash flow for the benefit of the owners; speculations do not. They return to the owners of speculations depends exclusively on the vagaries of the resale market.

- If you look to Mr. Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr. Market for investment guidance, however, you are probably best advised to hire someone else to manage your money.

- Many unsuccessful investors regard the stock market as a way to make money without working rather than as a way to invest capital in order to earn a decent return. Anyone would enjoy a quick and easy profit, and the prospect of an effortless gain incites greed in investors. Greed leads many investors to seek shortcuts to investment success. Rather than allowing returns to compound over time, they attempt to turn quick profits by acting on hot tips. They do not stop to consider how the tipster could possibly be in possession of valuable information that is not illegally obtained or why, if it is so valuable, it is being made available to them. Greed also manifests itself as undue optimism or, more subtly, as complacency in the face of bad news. Finally greed can cause investors to shift their focus away from the achievement of long-term investment goals in favor of short-term speculation

- It is human nature to seek simple solutions to problems, however complex. Given the complexities of the investment process, it is perhaps natural for people to feel that only a formula could lead to investment success. Just as many generals persist in fighting the last war, most investment formulas project the recent past into the future. Some investment formulas involve technical analysis, in which past stock-price movements are considered predictive of future prices. Other formulas incorporate investment fundamentals such as price-to-earnings (P/E) ratios, price-to-book-value ratio, sales or profits growth rates, dividend yields, and the prevailing level of interest rates. Despite the enormous effort that has been put into devising such formulas, none has been proven to work.

- Nature of Wall Street Works Against Investors

- Wall Streeters get paid primarily for what they do, not how effectively they do it. Wall Street's traditional compensation is in the form of up-front fees and commissions. Brokerage com-missions are collected on each trade, regardless of the outcome for the investor. Investment banking and underwriting fees are also collected up front, long before the ultimate success or fail-ure of the transaction is known. All investors are aware of the conflict of interest facing stockbrokers. While their customers might be best off owning (minimal commission) U.S. Treasury bills or (commission-free) no-load mutual funds, brokers are financially motivated to sell high-commission securities. Brokers also have an incentive to do excessive short-term trading (known as churning) on behalf of discretionary customer accounts (in which the broker has discretion to transact) and to encourage such activity in nondiscretionary accounts. Many investors are also accustomed to conflicts of interest in Wall Street's trading activities, where the firm and customer are on opposite sides of what is often a zero-sum game.

- The point I am making is that investors should be aware of the motivations of the people they transact business with; up-front fees clearly create a bias toward frequent, and not necessarily profitable, transactions.

- The Institutional Performance Derby: The Client is the Loser

- Economist Paul Rosenstein-Rodan has pointed to the "tremble factor" in understanding human motivation. "In the building practices of ancient Rome, when scaffolding was removed from a completed Roman arch, the Roman engineer stood beneath. If the arch came crashing down, he was the first to know. Thus his concern for the quality of the arch was intensely personal, and it is not surprising that so many Roman arches have survived."

- Remaining fully invested at all times certainly simplifies the investment task. The investor simply chooses the best available investments. Relative attractiveness becomes the only investment yardstick; no absolute standard is to be met. Unfortunately the important criterion of investment merit is obscured or lost when substandard investments are acquired solely to remain fully invested. Such investments will at best generate mediocre returns; at worst they entail both a high opportunity cost—foregoing the next good opportunity to invest—and the risk of appreciable loss.

- Remaining fully invested at all times is consistent with a relative-performance orientation. If one's goal is to beat the market (particularly on a short-term basis) without falling significantly behind, it makes sense to remain 100 percent invested. Funds that would otherwise be idle must be invested in the market in order not to underperforms the market. Absolute-performance-oriented investors, by contrast, will buy only when investments meet absolute standards of value. They will choose to be fully invested only when available opportunities are both sufficient in number and compelling in attractiveness, preferring to remain less than fully invested when both conditions are not met. In investing, there are times when the best thing to do is nothing at all. Yet institutional money managers are unlikely to adopt this alternative unless most of their competitors are similarly inclined.

- Investing without understanding the behavior of institutional investors is like driving in a foreign land without a map. You may eventually get where you are going, but the trip will certainly take longer, and you risk getting lost along the way.

- Avoiding losses is the most important prerequisite to investment success

- Defining Your Investment Goals

- Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

- Greedy, short-term-oriented investors may lose sight of a sound mathematical reason for avoiding loss: the effects of compounding even moderate returns over many years are com-pelling, if not downright mind boggling. Table 1 shows the delightful effects of compounding even relatively small amounts.

- Investors must be willing to forego some near-term return, if necessary, as an insurance premium against unexpected and unpredictable adversity.

- Rather than targeting a desired rate of return, even an eminently reasonable one, investors should target risk

- Value Investing: The Importance of a Margin of Safety

- Value investing is the discipline of buying securities at a significant discount from their current underlying values and holding them until more of their value is realized. The element of a bar-gain is the key to the process. In the language of value investors, this is referred to as buying a dollar for fifty cents. Value investing combines the conservative analysis of underlying value with the requisite discipline and patience to buy only when a sufficient discount from that value is available. The number of available bargains varies, and the gap between the price and value of any given security can be very narrow or extremely wide. Sometimes a value investor will review in depth a great many potential investments without finding a single one that is sufficiently attractive. Such persistence is necessary, however, since value is often well hidden. The disciplined pursuit of bargains makes value investing very much a risk-averse approach. The greatest challenge for value investors is maintaining the required discipline. Being a value investor usually means standing apart from the crowd, challenging conventional wisdom, and opposing the prevailing investment winds. It can be a very lonely undertaking. A value investor may experience poor, even horrendous, performance compared with that of other investors or the market as a whole during prolonged periods of market overvaluation. Yet over the long run the value approach works so successfully that few, if any, advocates of the philosophy ever abandon it.

- Value investors continually compare potential new investments with their current holdings in order to ensure that they own only the most undervalued opportunities available. Investors should never be afraid to reexamine current holdings as new opportunities appear, even if that means realizing losses on the sale of current holdings. In other words, no investment should be considered sacred when a better one comes along.

- Because investing is as much an art as a science, investors need a margin of safety. A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world. According to Graham, "The margin of safety is always dependent on the price paid. For any security, it will be large at one price, small at some higher price, nonexistent at some still higher price." Buffett described the margin of safety concept in terms of tolerances: "When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000-pound trucks across it. And that same principle works in investing."

- How can investors be certain of achieving a margin of safety? By always buying at a significant discount to underlying business value and giving preference to tangible assets over intangibles. (This does not mean that there are not excellent investment opportunities in businesses with valuable intangible assets.) By replacing current holdings as better bargains come along. By selling when the market price of any investment comes to reflect its underlying value and by holding cash, if necessary, until other attractive investments become available. Investors should pay attention not only to whether but also to why current holdings are undervalued. It is critical to know why you have made an investment and to sell when the reason for owning it no longer applies. Look for investments with catalysts that may assist directly in the realization of underlying value. Give preference to companies having good managements with a personal financial stake in the business.

- A market downturn is the true test of an investment philosophy. Securities that have performed well in a strong market are usually those for which investors have had the highest expectations.

- Investors should understand not only what value investing is but also why it is a successful investment philosophy. At the very core of its success is the recurrent mispricing of securities in the marketplace. Value investing is, in effect, predicated on the proposition that the efficient-market hypothesis is frequently wrong. If, on the one hand, securities can become undervalued or overvalued, which I believe to be incontrovert-ibly true, value investors will thrive. If, on the other hand, all securities at some future date become fairly and efficiently priced, value investors will have nothing to do. It is important, then, to consider whether or not the financial markets are efficient.

- The efficient-market hypothesis takes three forms. The weak form maintains that past stock prices provide no useful information on the future direction of stock prices. In other words, technical analysis (analysis of past price fluctuations) cannot help investors. The semistrong form says that no published information will help investors to select undervalued securities since the market has already discounted all publicly available information into securities prices. The strong form maintains that there is no information, public or private, that would benefit investors. The implication of both the semi-strong and strong forms is that fundamental analysis is useless. Investors might just as well select stocks at random.

- An entire book could be written on this subject alone, but one enlightening article cleverly rebuts the efficient-market theory with living, breathing refutations. Buffett's "The Superinvestors of Graham-and-Doddsville" demonstrates how nine value-investment disciples of Benjamin Graham, holding varied and independent portfolios, achieved phenomenal investment success over long periods.

- In a sense, value investing is a large-scale arbitrage between security prices and underlying business value. Arbitrage is a means of exploiting price differentials between markets.

- At the Root of a Value-Investment Philosophy

- There are three central elements to a value-investment philosophy. First, value investing is a bottom-up strategy entailing the identification of specific undervalued investment opportunities. Second, value investing is absolute-performance-, not relative-performance oriented. Finally, value investing is a risk-averse approach; attention is paid as much to what can go wrong (risk) as to what can go right (return).

- In investing it is never wrong to change your mind. It is only wrong to change your mind and do nothing about it.

- The risk of an investment is described by both the probability and the potential amount of loss. The risk of an investment— the probability of an adverse outcome—is partly inherent in its very nature. A dollar spent on biotechnology research is a riskier investment than a dollar used to purchase utility equipment. The former has both a greater probability of loss and a greater percentage of the investment at stake.

- Unlike return, however, risk is no more quantifiable at the end of an investment than it was at its beginning. Risk simply cannot be described by a single number. Intuitively we under-stand that risk varies from investment to investment: a government bond is not as risky as the stock of a high-technology company. But investments do not provide information about their risks the way food packages provide nutritional data. Rather, risk is a perception in each investor's mind that results from analysis of the probability and amount of potential loss from an investment. If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky. But if the well is a gusher, the bond matures on schedule, and the stock rallies strongly, can we say they weren't risky when the investment was made? Not at all. The point is, in most cases no more is known about the risk of an investment after it is concluded than was known when it was made. There are only a few things investors can do to counteract risk: diversify adequately, hedge when appropriate, and invest with a margin of safety. It is precisely because we do not and cannot know all the risks of an investment that we strive to invest at a discount. The bargain element helps to provide a cushion for when things go wrong.

- The trick of successful investors is to sell when they want to, not when they have to. Investors who may need to sell should not own marketable securities other than U.S. Treasury bills.

- The Art of Business Valuation

- In Security Analysis he and David Dodd discussed the concept of a range of value:

- The essential point is that security analysis does not seek to determine exactly what is the intrinsic value of a given security. It needs only to establish that the value is adequate—e.g., to protect a bond or to justify a stock purchase—or else that the value is considerably higher or considerably lower than the market price. For such purposes an indefinite and approximate measure of the intrinsic value may be sufficient.

- To be a value investor, you must buy at a discount from underlying value. Analyzing each potential value investment opportunity therefore begins with an assessment of business value. While a great many methods of business valuation exist, there are only three that I find useful. The first is an analysis of going-concern value, known as net present value (NPV) analy-sis. NPV is the discounted value of all future cash flows that a business is expected to generate. A frequently used but flawed shortcut method of valuing a going concern is known as private-market value. This is an investor's assessment of the price that a sophisticated businessperson would be willing to pay for a business.

- How do value investors deal with the analytical necessity to predict the unpredictable? The only answer is conservatism. Since all projections are subject to error, optimistic ones tend to place investors on a precarious limb. Virtually everything must go right, or losses may be sustained. Conservative forecasts can be more easily met or even exceeded. Investors are well advised to make only conservative projections and then invest only at a substantial discount from the valuations derived therefrom.

- The other component of present-value analysis, choosing a discount rate, is rarely given sufficient consideration by investors. A discount rate is, in effect, the rate of interest that would make an investor indifferent between present and future dollars. Investors with a strong preference for present over future consumption or with a preference for the certainty of the present to the uncertainty of the future would use a high rate for discounting their investments. Other investors may be more willing to take a chance on forecasts holding true; they would apply a low discount rate, one that makes future cash flows nearly as valuable as today's. There is no single correct discount rate for a set of future cash flows and no precise way to choose one. The appropriate discount rate for a particular investment depends not only on an investor's preference for present over future consumption but also on his or her own risk profile, on the perceived risk of the investment under consideration, and on the returns available from alternative investments.

- A valuation method related to net present value is private-market value, which values businesses based on the valuation multiples that sophisticated, prudent businesspeople have recently paid to purchase similar businesses. Private-market value can provide investors with useful rules of thumb based on the economics of past transactions to guide them in business valuation. This valuation method is not without its shortcomings, however. Within a given business or industry all companies are not the same, but private-market value fails to distinguish among them. Moreover, the multiples paid to acquire businesses vary over time; valuations may have changed since the most recent similar transaction. Finally, buyers of businesses do not necessarily pay reasonable, intelligent prices.

- The liquidation value of a business is a conservative assessment of its worth in which only tangible assets are considered and intangibles, such as going-concern value, are not. Accordingly, when a stock is selling at a discount to liquidation value per share, a near rock-bottom appraisal, it is frequently an attractive investment.

- In The Alchemy of Finance George Soros stated, "Fundamental analysis seeks to establish how underlying values are reflected in stock prices, whereas the theory of reflexivity shows how stock prices can influence underlying values."7 In other words, Soros's theory of reflexivity makes the point that its stock price can at times significantly influence the value of a business. Investors must not lose sight of this possibility.

- In Security Analysis he and David Dodd discussed the concept of a range of value:

- Investment Research: The Challenge of Finding Attractive Investments

- Value investing by its very nature is contrarian. Out-of-favor securities may be undervalued; popular securities almost never are. What the herd is buying is, by definition, in favor. Securities in favor have already been bid up in price on the basis of optimistic expectations and are unlikely to represent good value that has been overlooked.

- Obviously investors need to be alert to the motivations of managements at the companies in which they invest.

- Portfolio Management and Trading

- The challenge of successfully managing an investment portfolio goes beyond making a series of good individual investment decisions. Portfolio management requires paying attention to the portfolio as a whole, taking into account diversification, possible hedging strategies, and the management of portfolio cash flow. In effect, while individual investment decisions should take risk into account, portfolio management is a further means of risk reduction for investors. Even relatively safe investments entail some probability, however small, of downside risk. The deleterious effects of such improbable events can best be mitigated through prudent diver-sification. The number of securities that should be owned to reduce portfolio risk to an acceptable level is not great; as few as ten to fifteen different holdings usually suffice. Diversification for its own sake is not sensible. This is the index fund mentality: if you can't beat the market, be the market. Advocates of extreme diversification—which I think of as overdiversification—live in fear of company-specific risks; their view is that if no single position is large, losses from unanticipated events cannot be great. My view is that an investor is better off knowing a lot about a few investments than knowing only a little about each of a great many holdings. One's very best ideas are likely to generate higher returns for a given level of risk than one's hundredth or thousandth best idea.

- Diversification, after all, is not how many different things you own, but how different the things you do own are in the risks they entail.

- Some investors buy and hold for the long term, stashing their securities in the proverbial vault for years. While such a strategy may have made sense at some time in the past, it seems misguided today. This is because the financial markets are prolific creators of investment opportunities. Investors who are out of touch with the markets will find it difficult to be in touch with buying and selling opportunities regularly created by the markets. Today with so many market participants having little or no fundamental knowledge of the businesses their investments represent, opportunities to buy and sell seem to present themselves at a rapid pace.

- Being in touch with the market does pose dangers, however. Investors can become obsessed, for example, with every market uptick and downtick and eventually succumb to short-term-oriented trading. There is a tendency to be swayed by recent market action, going with the herd rather than against it. Investors unable to resist such impulses should probably not stay in close touch with the market; they would be well advised to turn their investable assets over to a financial professional

- The single most crucial factor in trading is developing the appropriate reaction to price fluctuations. Investors must learn to resist fear, the tendency to panic when prices are falling, and greed, the tendency to become overly enthusiastic when prices are rising. One half of trading involves learning how to buy. In my view, investors should usually refrain from purchasing a "full position" (the maximum dollar commitment they intend to make) in a given security all at once. Those who fail to heed this advice may be compelled to watch a subsequent price decline helplessly, with no buying power in reserve. Buying a partial position leaves reserves that permit investors to "average down," lowering their average cost per share, if prices decline.

- All investments are for sale at the right price. Decisions to sell, like decisions to buy, must be based upon underlying business value. Exactly when to sell—or buy— depends on the alternative opportunities that are available. Should you hold for partial or complete value realization, for example? It would be foolish to hold out for an extra fraction of a point of gain in a stock selling just below underlying value when the market offers many bargains. By contrast, you would not want to sell a stock at a gain (and pay taxes on it) if it were still significantly undervalued and if there were no better bargains available.

- Investment Alternatives for the Individual Investor

- Obviously a manager who has achieved dismal long-term results is not someone to hire to manage your money. Nevertheless, you would not necessarily hire the best-performing manager for a recent period either. Returns must always be examined in the context of risk. Consider asking whether the manager was fully invested at all times or even more than 100 percent invested through the use of borrowed money. (Leverage is neither necessary nor appropriate for most investors.)

What I got out of it

- A beautiful overview on value investing from one of the all-time greats