The Rabbit Hole is written by Blas Moros. To support, sign up for the newsletter, become a patron, and/or join The Latticework. Original Design by Thilo Konzok.

Key Takeaways

- Our main objective will be to guide the reader against the areas of possible substantial error and to develop policies with which he will be comfortable. We shall say quite a bit about the psychology of investors. For indeed, the investor's chief problem — and even his worst enemy — is likely to be himself.

- Unless you are confident in your analytical abilities and are willing to spend hours analyzing stocks, a dollar-cost averaging approach into low-fee indexed funds is the way to go

- In the past we have made a basic distinction between two kinds of investors to whom this book was addressed — the "defensive" and the "enterprising." The defensive (or passive) investor will place his chief emphasis on the avoidance of serious mistakes or losses. His second aim will be freedom from effort, annoyance, and the need for making frequent decisions. The determining trait of the enterprising (or active, or aggressive) investor is his willingness to devote time and care to the selection of securities that are both sound and more attractive than the average. Over many decades an enterprising investor of this sort could expect a worthwhile reward for his extra skill and effort, in the form of a better average

- The intelligent investor realizes that stocks become more risky, not less, as their prices rise-and less risky, not more, as their prices fall. The intelligent investor dreads a bull market, since it makes stocks more risky and expensive

- Note that investing, according to Graham, consists equally of three elements:

- You must thoroughly analyze a company, and the soundness of its underlying businesses, before you buy its stock

- You must deliberately protect yourself against serious losses

- You must aspire to "adequate," not extraordinary, performance

- Graham urges you to invest only if you would be comfortable owning a stock even if you had no way of knowing its daily share price

- Far from being an afterthought, dividends are the greatest force in stock investing.

- Viewed logically, the decision of whether to own stocks today has nothing to do with how much money you might have lost by owning them a few years ago. When stocks are priced reasonably enough to give you future growth, then you should own them, regardless of the losses they may have cost you in the recent past. That's all the more true when bond yields are low, reducing the future returns on income producing investments

- The costs of trading wear away your returns like so many swipes of sandpaper. Buying or selling a hot little stock can cost 2% to 4% (or 4% to 8% for a "round-trip" buy-and-sell transaction). If you put $1,000 into a stock, your trading costs could eat up roughly $40 before you even get started. Sell the stock, and you could fork over another 4% in trading expenses. Oh, yes-there's one other thing. When you trade instead of invest, you turn long-term gains (taxed at a maximum capital-gains rate of 20%) into ordinary income (taxed at a maximum rate of 38.6%). Add it all up, and a stock trader needs to gain at least 10% just to break even on buying and selling a stock. Anyone can do that once, by luck alone. To do it often enough to justify the obsessive attention it

- A great deal of brain power goes into this field, and undoubtedly some people can make money by being good stock- market analysts. But it is absurd to think that the general public can ever make money out of market forecasts.

- But note this important fact: The true investor scarcely ever is forced to sell his shares, and at all other times he is free to disregard the current price quotation. He need pay attention to it and act upon it only to the extent that it suits his book, and no more. Thus the investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage. That man would be better off if his stocks had no market quotation at all, for he would then be spared the mental anguish caused him by other persons' mistakes of judgment.

- This may well be the single most important paragraph in Graham's entire book. In these 113 words Graham sums up his lifetime of experience. You cannot read these words too often; they are like Kryptonite for bear markets. If you keep them close at hand and let them guide you throughout your investing life, you will survive whatever the markets throw at you

- Let us close this section with something in the nature of a parable. Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly. If you are a prudent investor or a sensible businessman, will you let Mr. Market's daily communication determine your view of the value of a $1,000 interest in the enterprise? Only in case you agree with him or in case you want to trade with him. You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low. But the rest of the time you will be wiser to form your own ideas of the value of your holdings, based on full reports from the company about its operations and financial position. The true investor is in that very position when he owns a listed common stock. He can take advantage of the daily market price or leave it alone, as dictated by his own judgment and inclination. He must take cognizance of important price movements, for otherwise his judgment will have nothing to work on. Conceivably they may give him a warning signal which he will do well to heed — this in plain English means that he is to sell his shares because the price has gone down, foreboding worse things to come. In our view such signals are misleading at least as often as they are helpful. Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.

- Recognize that investing intelligently is about controlling the controllable. You can't control whether the stocks or funds you buy will outperform the market today, next week, this month, or this year; in the short run, your returns will always be hostage to Mr. Market and his whims. But you can control: your brokerage costs, by trading rarely, patiently, and cheaply your ownership costs, by refusing to buy mutual funds with excessive annual expenses your expectations, by using realism, not fantasy, to forecast your returns your risk, by deciding how much of your total assets to put at hazard in the stock market, by diversifying, and by re-balancing your tax bills, by holding stocks for at least one year and, whenever possible, for at least five years, to lower your capital-gains liability and, most of all, your own behavior.

- Patience is the fund investor's single most powerful ally.

- As Graham put it: "In 44 years of Wall Street experience and study, I have never seen dependable calculations made about common-stock values, or related investment policies, that went beyond simple arithmetic or the most elementary algebra.

- This is one of the central points of Graham's book. All investors labor under a cruel irony: We invest in the present, but we invest for the future. And, unfortunately, the future is almost entirely uncertain

- Although there are good and bad companies, there is no such thing as a good stock; there are only good stock prices, which come and go.

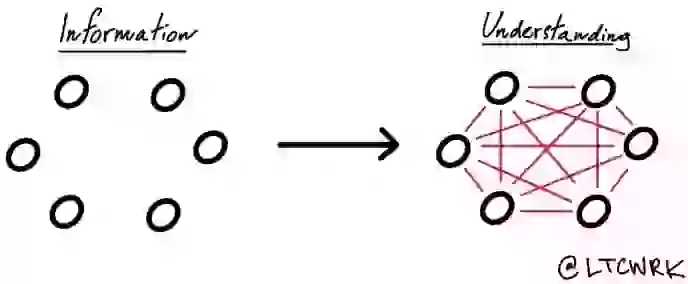

- As Graham liked to say, in the short run the market is a voting machine, but in the long run it is a weighing machine.

- The margin of safety is the difference between the percentage rate of the earnings on the stock at the price you pay for it and the rate of interest on bonds, and that margin of safety is the difference which would absorb unsatisfactory developments. The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price. For most investors, diversification is the simplest and cheapest way to widen your margin of safety.

What I got out of it

- It becomes quite clear why and how Ben Graham was one of the most successful investors in history. He sees investing in such a clear manner and by dissecting this this book he allows you to peer into his mental models and thought processes

- Through numerous examples and repetitions, Graham makes it obvious that unless you are willing to devote many hours into learning and researching different stocks, you should invest the majority of your money into low-index funds which track the market. This may seem boring but he proves that this is often a defensive investors best move and beats the vast majority of active investors anyway. Dollar-cost averaging, compounding and dividends are some of your best friends and should never be overlooked

- Offers too much good advice to try to summarize here and I recommend everybody, regardless of age or economic status to read this book. If the principles are adhered to, it truly has the power to change your life

- A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price

- The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The intelligent investor is a realist who sells to optimists and buys from pessimists.

- The future value of every investment is a function of its present price. The higher the price you pay, the lower your return will be. No matter how careful you are, the one risk no investor can ever eliminate is the risk of being wrong. Only by insisting on what Graham called the "margin of safety"-never overpaying, no matter how exciting an investment seems to be-can you minimize your odds of error.

- The secret to your financial success is inside yourself. If you become a critical thinker who takes no Wall Street "fact" on faith, and you invest with patient confidence, you can take steady advantage of even the worst bear markets.

- Swings govern your financial destiny. In the end, how your investments behave is much less important than how you behave.

- The purpose of this book is to supply, in a form suitable for laymen, guidance in the adoption and execution of an investment policy

- To invest intelligently in securities one should be forearmed with an adequate knowledge of how the various types of bonds and stocks have actually behaved under varying conditions — some of which, at least, one is likely to meet again in one's own experience. This record may be regarded as a persuasive argument for the principle of regular monthly purchases of strong common stocks through thick and thin — a program known as "dollar-cost averaging."

- The one principle that applies to nearly all these so-called "technical approaches" is that one should buy because a stock or the market has gone up and one should sell because it has declined. This is the exact opposite of sound business sense everywhere else, and it is most unlikely that it can lead to lasting success on Wall Street

- The underlying principles of sound investment should not alter from decade to decade, but the application of these principles must be adapted to significant changes in the financial mechanisms and climate

- It has long been the prevalent view that the art of successful investment lies first in the choice of those industries that are most likely to grow in the future and then in identifying the most promising companies in these industries.

- Obvious prospects for physical growth in a business do not translate into obvious profits for investors.

- The experts do not have dependable ways of selecting and concentrating on the most promising companies in the most promising industries.

- It is commonly accepted today that the cumulative earnings of the airline industry over its entire history have been negative. The lesson Graham is driving at is not that you should avoid buying airline stocks, but that you should never succumb to the "certainty" that any industry will outperform all others in the future.

- We have seen much more money made and kept by "ordinary people" who were temperamentally well suited for the investment process than by those who lacked this quality, even though they had an extensive knowledge of finance, accounting, and stock market lore

- Strangely enough, we shall suggest as one of our chief requirements here that our readers limit themselves to issues selling not far above their tangible-asset value.

- Tangible assets include a company's physical property (like real estate, factories, equipment, and inventories) as well as its financial balances (such as cash, short-term investments, and accounts receivable). Among the elements not included in tangible assets are brands, copyrights, patents, franchises, goodwill, and trademarks.)

- By contrast, the investor in shares, say, of public-utility companies at about their net-asset value can always consider himself the owner of an interest in sound and expanding businesses, acquired at a rational price — regardless of what the stock market might say to the contrary

- A strong-minded approach to investment, firmly based on the margin-of-safety principle, can yield handsome rewards. But a decision to try for these emoluments rather than for the assured fruits of defensive investment should not be made without much self-examination. this book will teach you three powerful lessons:

- How you can minimize the odds of suffering irreversible losses

- How you can maximize the chances of achieving sustainable gains

- How you can control the self-defeating behavior

- Once you lose 95% of your money, you have to gain 1,900% just to get back to where you started. First rule of investing, do not lose money

- While it seems easy to foresee which industry will grow the fastest, that foresight has no real value if most other investors are already expecting the same thing. By the time everyone decides that a given industry is "obviously" the best one to invest in, the prices of its stocks have been bid up so high that its future returns have nowhere to go but down

- So long as you keep enough cash on hand to meet your spending needs, you should welcome a bear market, since it puts stocks back on sale.

- An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.

- Outright speculation is neither illegal, immoral, nor (for most people) fattening to the pocketbook. More than that, some speculation is necessary and unavoidable, for in many common-stock situations there are substantial possibilities of both profit and loss, and the risks therein must be assumed by someone. There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.

- We recommended that the investor divide his holdings between high-grade bonds and leading common stocks; that the proportion held in bonds be never less than 25% or more than 75%, with the converse being necessarily true for the common-stock component

- Since you cannot predict the behavior of the markets, you must learn how to predict and control your own behavior.

- For reasons to be developed elsewhere we are skeptical of the ability of defensive investors generally to get better than average results — which in fact would mean to beat their own overall performance

- The defensive investor must confine himself to the shares of important companies with a long record of profitable operations and in strong financial condition

- Must purchase the shares of well-established investment funds as an alternative to creating his own common-stock portfolio

- Utilize one of the "common trust funds," or "commingled funds," operated by trust companies and banks in many states.

- Take advantage of of "dollar-cost averaging," which means simply that the practitioner invests in common stocks the same number of dollars each month or each quarter. In this way he buys more shares when the market is low than when it is high, and he is likely to end up with a satisfactory overall price for all his holdings

- We are thus led to the following logical if disconcerting conclusion: To enjoy a reasonable chance for continued better than average results, the investor must follow policies which are (1) inherently sound and promising, and (2) not popular on Wall Street.

- An investor calculates what a stock is worth, based on the value of its businesses. A speculator gambles that a stock will go up in price because somebody else will pay even more for it

- The intelligent investor never dumps a stock purely because its share price has fallen; she always asks first whether the value of the company's underlying businesses has changed.

- Oscar Wilde joked that a cynic "knows the price of everything, and the value of nothing."

- As Graham never stops reminding us, stocks do well or poorly in the future because the businesses behind them do well or poorly-nothing more, and nothing less.

- All this reinforces Graham's warning that you must treat speculation as veteran gamblers treat their trips to the casino:

- You must never delude yourself into thinking that you're investing when you're speculating

- Speculating becomes mortally dangerous the moment you begin to take it seriously

- You must put strict limits on the amount you are willing to wager

- For most of us, 10% of our overall wealth is the maximum permissible amount to put at speculative risk. Never mingle the money in your speculative account with what's in your investment accounts; never allow your speculative thinking to spill over into your investing activities; and never put more than 10% of your assets into your "mad money account," no matter what happens

- Our readers must have enough intelligence to recognize that even high-quality stocks cannot be a better purchase than bonds under all conditions

- In this matter, as in so many others in finance, we must base our views of future policy on a knowledge of past experience

- Is there a persuasive reason to believe that common stocks are likely to do much better in future years than they have in the last five and one-half decades? Our answer to this crucial question must be a flat no.

- There is no close time connection between inflationary (or deflationary) conditions and the movement of common-stock earnings and prices.

- It took 25 years for General Electric (and the DJIA itself) to recover the ground lost in the 1929-1932 debacle. Besides that, if the investor concentrates his portfolio on common stocks he is very likely to be led astray either by exhilarating advances or by distressing declines.

- Financial adviser William Bernstein agrees, pointing out that a tiny allocation to a precious-metals fund (say, 2% of your total assets) is too small to hurt your overall returns when gold does poorly. But, when gold does well, its returns are often so spectacular-sometimes exceeding 100%

- The outright ownership of real estate has long been considered as a sound long-term investment, carrying with it a goodly amount of protection against inflation. Unfortunately, real-estate values are also subject to wide fluctuations; serious errors can be made in location, price paid, etc.

- The more the investor depends on his portfolio and the income therefrom, the more necessary it is for him to guard against the unexpected and the disconcerting in this part of his life.

- Money Illusion - So long as the nominal (or absolute) change is positive, we view it as a good thing-even if the real (or after-inflation) result is negative

- Inflation is so easy to overlook-and why it's so important to measure your investing success not just by what you make, but by how much you keep after inflation.

- Completely eradicating inflation runs against the economic self-interest of any government that regularly borrows money.

- In a time of deflation (or steadily falling prices) it's more advantageous to be a lender than a borrower-which is why most investors should keep at least a small portion of their assets in bonds, as a form of insurance against deflating prices.

- Real Estate Investment Trusts, or REITs (pronounced "reets"), are companies that own and collect rent from commercial and residential properties. Bundled into real-estate mutual funds, REITs do a decent job of combating inflation (Vanguard REIT Index Fund)

- TIPS also guarantee that the value of your investment won't be eroded by inflation. In one easy package, you insure yourself against financial loss and the loss of purchasing power. TIPS are best suited for a tax-deferred retirement account like an IRA, Keogh, or 401 (k), where they will not jack up your taxable income.

- For most investors, allocating at least 10% of your retirement assets to TIPS is an intelligent way to keep a portion of your money absolutely safe-and entirely beyond the reach of the long, invisible claws of inflation.

- The "price/earnings ratio" of a stock, or of a market average like the S&P 500-stock index, is a simple tool for taking the market's temperature. If, for instance, a company earned $1 per share of net income over the past year, and its stock is selling at $8.93 per share, its price/earnings ratio would be 8.93; if, however, the stock is selling at $69.70, then the price/earnings ratio would be 69.7. In general, a price/earnings ratio (or "P/E" ratio) below 10 is considered low, between 10 and 20 is considered moderate, and greater than 20 is considered expensive.

- The heart of Graham's argument is that the intelligent investor must never forecast the future exclusively by extrapolating the past

- Is the stock market riskier today than two years ago simply because prices are higher? The answer is yes. It always has been. It always will be.

- Anyone who claims that the long-term record "proves" that stocks are guaranteed to outperform bonds or cash is an ignoramus

- Since the profits that companies can earn are finite, the price that investors should be willing to pay for stocks must also be finite.

- Gallup found in 2001 and 2002 that the average expectation of one-year returns on stocks had slumped to 7%-even though investors could now buy at prices nearly 50% lower than in 2000.

- The more enthusiastic investors become about the stock market in the long run, the more certain they are to be proved wrong in the short run.

- The stock market's performance depends on three factors: real growth (the rise of companies' earnings and dividends) inflationary growth (the general rise of prices throughout the economy) speculative growth-or decline (any increase or decrease in the investing public's appetite for stocks)

- In the long run, the yearly growth in corporate earnings per share has averaged 1.5% to 2% (not counting inflation). As of early 2003, inflation was running around 2.4% annually; the dividend yield on stocks was 1 .9%. So, 1 .5% to 2% + 2.4% + 1 .9% = 5.8% to 6.3%. In the long run, that means you can reasonably expect stocks to average roughly a 6% return (or 4% after inflation).

- By scanning the historical record, Shiller has shown that when his ratio goes well above 20, the market usually delivers poor returns afterward; when it drops well below 10, stocks typically produce handsome gains down the road.

- The only indisputable truth that the past teaches us is that the future will always surprise us-always!

- The rate of return sought should be dependent, rather, on the amount of intelligent effort the investor is willing and able to bring to bear on his task. The minimum return goes to our passive investor, who wants both safety and freedom from concern. The maximum return would be realized by the alert and enterprising investor who exercises maximum intelligence and skill.

- State and municipal bonds. These enjoy exemption from Federal income tax. They are also ordinarily free of income tax in the state of issue but not elsewhere

- In practical terms, we advise the investor in long-term issues to sacrifice a small amount of yield to obtain the assurance of noncallability — say for 20 or 25 years. Similarly there is an advantage in buying a low-coupon bond at a discount rather than a high coupon bond selling at about par and callable in a few years.

- Really good preferred stocks can and do exist, but they are good in spite of their investment form, which is an inherently bad one.

- With every new wave of optimism or pessimism, we are ready to abandon history and time-tested principles, but we cling tenaciously and unquestioningly to our prejudices

- There are two ways to be an intelligent investor:

- By continually researching, selecting, and monitoring a dynamic mix of stocks, bonds, or mutual funds;

- Or by creating a permanent portfolio that runs on autopilot and requires no further effort (but generates very little excitement).

- As the investment thinker Charles Ellis has explained, the enterprising approach is physically and intellectually taxing, while the defensive approach is emotionally demanding. Both approaches are equally intelligent, and you can be successful with either-but only if you know yourself well enough to pick the right one, stick with it over the course of your investing lifetime, and keep your costs and emotions under control. Graham's distinction between active and passive investors is another of his reminders that financial risk lies not only where most of us look for it-in the economy or in our investments-but also within ourselves inflation is one of your worst enemies everyone must keep some assets in the riskless haven of cash

- Once you set the target percentages of your portfolio, change them only as your life circumstances change. Do not buy more stocks because the stock market has gone up; do not sell them because it has gone down. The very heart of Graham's approach is to replace guesswork with discipline.

- I suggest that you rebalance every six months, no more and no less, on easy-to-remember dates like New Year's and the Fourth of July. The beauty of this periodic rebalancing is that it forces you to base your investing decisions on a simple, objective standard-Do I now own more of this asset than my plan calls for?-instead of the sheer guesswork of where interest rates are heading or whether you think the Dow is about to drop dead

- Two good online calculators that will help you compare the after-tax income of municipal and taxable bonds can be found at www.investinginbonds.com/cgi-bin/calculator.pl and www.lebenthal.com/index_infocenter.html.

- For a simple explanation of bonds, see http://mystockmarketbasics.com/fixed-income-investments/

- A "laddered" portfolio, holding bonds across a range of maturities, is another way of hedging interest-rate risk.

- Buying individual bonds makes no sense unless you have at least $100,000 to invest. Bond funds offer cheap and easy diversification, along with the convenience of monthly income, which you can reinvest right back into the fund at current rates without paying a commission. If you had invested $1 in U.S. stocks in 1900 and spent all your dividends, your stock portfolio would have grown to $198 by 2000. But if you had reinvested all your dividends, your stock portfolio would have been worth $16,797! Far from being an afterthought, dividends are the greatest force in stock investing.

- The selection of common stocks for the portfolio of the defensive investor should be a relatively simple matter. Here we would suggest four rules to be followed:

- There should be adequate though not excessive diversification. This might mean a minimum of ten different issues and a maximum of about thirty. Each company selected should be large, prominent, and conservatively financed. Indefinite as these adjectives must be, their general sense is clear.

- Each company should have a long record of continuous dividend payments.

- The investor should impose some limit on the price he will pay for an issue in relation to its average earnings over, say the past seven years. We suggest that this limit be set at 25 times such average earnings, and not more than 20 times those of the last twelve-month period. But such a restriction would eliminate nearly all the strongest and most popular companies from the portfolio.

- Today's defensive investor should probably insist on at least 10 years of continuous dividend payments

- By "the rule of 72," at 10% interest a given amount of money doubles in just over seven years, while at 7% it doubles in just over 10 years.

- When interest rates are high, the amount of money you need to set aside today to reach a given value in the future is lower because those high interest rates will enable it to grow at a more rapid rate. Thus a rise in interest rates today makes a future stream of earnings or dividends less valuable-since the alternative of investing in bonds has become relatively more attractive.

- Investors can now set up their own automated system to monitor the quality of their holdings by using interactive "portfolio trackers" at such websites as www.quicken.com, moneycentral.msn.com, finance.yahoo.com, and www.morningstar.com. Graham would, however, warn against relying exclusively on such a system; you must use your own judgment to supplement

- The New York Stock Exchange has put considerable effort into popularizing its "monthly purchase plan," under which an investor devotes the same dollar amount each month to buying one or more common stocks. This is an application of a special type of "formula investment" known as dollar-cost averaging.

- Common stocks are becoming generally accepted as a necessary component of a sound savings-investment program. Thus, systematic and uniform purchases of common stocks may present no more psychological and financial difficulties than similar continuous payments for United States savings bonds and for life insurance — to which they should be complementary. The monthly amount may be small, but the results after 20 or more years can be impressive and important to the saver.

- We urge the beginner in security buying not to waste his efforts and his money in trying to beat the market. Let him study security values and initially test out his judgment on price versus value with the smallest possible sums.

- Thus we return to the statement, made at the outset, that the kind of securities to be purchased and the rate of return to be sought depend not on the investor’s financial resources but on his financial equipment in terms of knowledge, experience, and temperament.

- Many common stocks do involve risks of such deterioration. But it is our thesis that a properly executed group investment in common stocks does not carry any substantial risk of this sort and that therefore it should not be termed "risky" merely because of the element of price fluctuation

- In today's markets, to be considered large, a company should have a total stock value (or "market capitalization") of at least $10 billion.

- After you burn your mouth on hot milk, you blow on your yogurt." Because the crash of 2000-2002 was so terrible, many investors now view stocks as scaldingly risky; but, paradoxically, the very act of crashing has taken much of the risk out of the stock market. It was hot milk before, but it is room-temperature yogurt now.

- Peter Lynch-who from 1977 through 1990 piloted Fidelity Magellan to the best track record ever compiled by a mutual fund-was the most charismatic preacher of this gospel. Lynch argued that amateur investors have an advantage that professional investors have forgotten how to use: "the power of common knowledge." If you discover a great new restaurant, car, toothpaste, or jeans-or if you notice that the parking lot at a nearby business is always full or that people are still working at a company's headquarters long after Jay Leno goes off the air-then you have a personal insight into a stock that a professional analyst or portfolio manager might never pick up on. As Lynch put it, "During a lifetime of buying cars or cameras, you develop a sense of what's good and what's bad, what sells and what doesn't . . . and the most important part is, you know it before Wall Street knows it."

- Lynch's rule-"You can outperform the experts if you use your edge by investing in companies or industries you already understand" isn’t totally implausible, and thousands of investors have profited from it over the years. But Lynch's rule can work only if you follow its corollary as well: "Finding the promising company is only the first step. The next step is doing the research." To his credit, Lynch insists that no one should ever invest in a company, no matter how great its products or how crowded its parking lot, without studying its financial statements and estimating its business value.

- That's why "investing in what you know" can be so dangerous; the more you know going in, the less likely you are to probe a stock for weaknesses. This pernicious form of overconfidence is called "home bias," or the habit of sticking to what is already familiar. Familiarity breeds complacency

- Unless you are not willing to spread your bets, you shouldn't bet at all.

- If, after you set up such an online autopilot portfolio, you find yourself trading more than twice a year-or spending more than an hour or two per month, total, on your investments-then something has gone badly wrong. Do not let the ease and up-to-the-minute feel of the Internet seduce you into becoming a speculator. A defensive investor runs-and wins-the race by sitting still.

- The ideal way to dollar-cost average is into a portfolio of index funds, which own every stock or bond worth having. That way, you renounce not only the guessing game of where the market is going but which sectors of the market-and which particular stocks or bonds within them-will do the best. Let's say you can spare $500 a month. By owning and dollar-cost averaging into just three index funds-$300 into one that holds the total U.S. stock market, $100 into one that holds foreign stocks, and $100 into one that holds U.S. bonds-you can ensure that you own almost every investment on the planet that's worth owning

- According to Ibbotson Associates, the leading financial research firm, if you had invested $12,000 in the Standard & Poor's 500-stock index at the beginning of September 1929, 10 years later you would have had only $7,223 left. But if you had started with a paltry $100 and simply invested another $1 00 every single month, then by August 1 939, your money would have grown to $1 5,571! That's the power of disciplined buying-even in the face of the Great Depression and the worst bear market of all time

- By enabling you to say "I don't know and I don't care," a permanent autopilot portfolio liberates you from the feeling that you need to forecast what the financial markets are about to do-and the illusion that anyone else can. The knowledge of how little you can know about the future, coupled with the acceptance of your ignorance, is a defensive investor's most powerful weapon.

- We have no concrete reason to be concerned about the future history of well-regarded foreign bonds such as those of Australia or Norway. But we do know that, if and when trouble should come, the owner of foreign obligations has no legal or other means of enforcing his claim.

- Our one recommendation is that all investors should be wary of new issues — which mean, simply, that these should be subjected to careful examination and unusually severe tests before they are purchased. There are two reasons for this double caveat. The first is that new issues have special salesmanship behind them, which calls therefore for a special degree of sales resistance. The second is that most new issues are sold under "favorable market conditions" - which means favorable for the seller and consequently less favorable for the buyer corporations choose to offer new shares to the public when the stock market is near a peak?

- Bull-market periods are usually characterized by the transformation of a large number of privately owned businesses into companies with quoted shares.

- By an unfortunate correlation, during the same period the stock-buying public has been developing an ingrained preference for the major companies and a similar prejudice against the minor ones. This prejudice, like many others, tends to become weaker as bull markets are built up; the large and quick profits shown by common stocks as a whole are sufficient to dull the public's critical faculty, just as they sharpen its acquisitive instinct.

- In Graham's day, the most prestigious investment banks generally steered clear of the Initial Public Offering (IPO) business, which was regarded as an undignified exploitation of naive investors

- Some of these new issues may prove excellent buys — a few years later, when nobody wants them and they can be had at a small fraction of their true worth

- No sane investor would put more than 10°/o of a total bond portfolio in spicy holdings like these [emerging markets]. But emerging markets bond funds seldom move in sync with the U.S. stock market, so they are one of the rare investments that are unlikely to drop merely because the Dow is down. That can give you a small corner of comfort in your portfolio just when you may need it most

- The lesson is clear: Don't just do something, stand there. It's time for everyone to acknowledge that the term "long-term investor" is redundant. A long-term investor is the only kind of investor there is. Someone who can't hold on to stocks for more than a few months at a time is doomed to end up not as a victor but as a victim.

- If, like nearly every investor, you can get access to IPOs only after their shares have rocketed above the exclusive initial price, your results will be terrible. From 1980 through 2001, if you had bought the average IPO at its first public closing price and held on for three years, you would have underperformed the market by more than 23% annually]

- More important, buying IPOs is a bad idea because it flagrantly violates one of Graham's most fundamental rules: No matter how many other people want to buy a stock, you should buy only if the stock is a cheap way to own a desirable business.

- The activities specially characteristic of the enterprising investor in the common-stock field may be classified under four heads: Buying in low markets and selling in high markets, Buying carefully chosen "growth stocks" ; Buying bargain issues of various types, Buying into "special situations"

- There are two catches to this simple idea. The first is that common stocks with good records and apparently good prospects sell at correspondingly high prices. The investor may be right in his judgment of their prospects and still not fare particularly well, merely because he has paid in full (and perhaps overpaid) for the expected prosperity. The second is that his judgment as to the future may prove wrong. Unusually rapid growth cannot keep up forever; when a company has already registered a brilliant expansion, its very increase in size makes a repetition of its achievement more difficult. At some point the growth curve flattens out, and in many cases it turns downward

- For the defensive investor we suggested an upper limit of purchase price at 25 times average earnings of the past seven years. Notice that Graham insists on calculating the price/earnings ratio based on a multiyear average of past earnings. That way, you lower the odds that you will overestimate a company's value based on a temporarily high burst of profitability.

- It's worth noting that the prevailing method on Wall Street today basing price/earnings ratios primarily on "next year's earnings"-would be anathema to Graham. How can you value a company based on earnings it hasn't even generated yet?

- To obtain better than average investment results over a long pull requires a policy of selection or operation possessing a twofold merit: (1) It must meet objective or rational tests of underlying soundness; and (2) it must be different from the policy followed by most investors or speculators.

- The key requirement here is that the enterprising investor concentrates on the larger companies that are going through a period of unpopularity. First, they have the resources in capital and brain power to carry them through adversity and back to a satisfactory earnings base. Second, the market is likely to respond with reasonable speed to any improvement shown.

- A remarkable demonstration of the soundness of this thesis is found in studies of the price behavior of the unpopular issues in the Dow Jones Industrial Average. In these it was assumed that an investment was made each year in either the six or the ten issues in the DJIA which were selling at the lowest multipliers of their current or previous year's earnings. These could be called the "cheapest" stocks in the list, and their cheapness was evidently the reflection of relative unpopularity with investors or traders. It was assumed further that these purchases were sold out at the end of holding periods ranging from one to five years. The results of these investments were then compared with the results shown in either the DJIA as a whole or in the highest multiplier (i.e., the most popular) group

- The Drexel computation shows further that an original investment of $10,000 made in the low-multiplier issues in 1936, and switched each year in accordance with the principle, would have grown to $66,900 by 1962. The same operations in high-multiplier stocks would have ended with a value of only $25,300; while an operation in all thirty stocks would have increased the original fund to $44,000. (Greenblatt’s MFI Theory)

- To be as concrete as possible, let us suggest that an issue is not a true "bargain" unless the indicated value is at least 50% more than the price.

- There are two tests by which a bargain common stock is detected. The first is by the method of appraisal. This relies largely on estimating future earnings and then multiplying these by a factor appropriate to the particular issue. If the resultant value is sufficiently above the market price — and if the investor has confidence in the technique employed — he can tag the stock as a bargain. The second test is the value of the business to a private owner. This value also is often determined chiefly by expected future earnings — in which case the result may be identical with the first. But in the second test more attention is likely to be paid to the realizable value of the assets, with particular emphasis on the net current assets or working capital

- Thus we have what appear to be two major sources of undervaluation: (1) currently disappointing results and (2) protracted neglect or unpopularity. The ideal combination here is thus that of a large and prominent company selling both well below its past average price and its past average price /earnings multiplier

- The type of bargain issue that can be most readily identified is a common stock that sells for less than the company's net working capital alone, after deducting all prior obligations. This would mean that the buyer would pay nothing at all for the fixed assets — buildings, machinery, etc., or any goodwill items that might exist. By "net working capital," Graham means a company's current assets (such as cash, marketable securities, and inventories) minus its total liabilities (including preferred stock and long-term debt).

- Substantial profits from the purchase of secondary companies at bargain prices arise in a variety of ways. First, the dividend return is relatively high. Second, the reinvested earnings are substantial in relation to the price paid and will ultimately affect the price. In a five- to seven-year period these advantages can bulk quite large in a well-selected list. Third, a bull market is ordinarily most generous to low-priced issues; thus it tends to raise the typical bargain issue to at least a reasonable level. Fourth, even during relatively featureless market periods a continuous process of price adjustment goes on, under which secondary issues that were undervalued may rise at least to the normal level for their type of security. Fifth, the specific factors that in many cases made for a disappointing record of earnings may be corrected by the advent of new conditions, or the adoption of new policies, or by a change in management

- The typical "special situation" has grown out of the increasing number of acquisitions of smaller firms by large ones, as the gospel of diversification of products has been adopted by more and more managements.

- Never buy into a lawsuit remains a valid rule for all but the most intrepid investors to live by.

- A study by two finance professors at Duke University found that if you had followed the recommendations of the best 10% of all market-timing newsletters, you would have earned a 12.6% annualized return from 1991 through 1995. But if you had ignored them and kept your money in a stock index fund, you would have earned 16.4%. 4 As the Danish philosopher Soren Kierkegaard noted, life can only be understood backwards-but it must be lived forwards

- The faster these companies grew, the more expensive their stocks became. And when stocks grow faster than companies, investors always end up sorry

- Growth stocks are worth buying when their prices are reasonable, but when their price/earnings ratios go much above 25 or 30 the odds get ugly: Journalist Carol Loomis found that, from 1960 through 1999, only eight of the largest 150 companies on the Fortune 500 list managed to raise their earnings by an annual average of at least 15% for two decades. Looking at five decades of data showed that only 10% of large U.S. companies had increased their earnings by 20% for at least five consecutive years; only 3% had grown by 20% for at least 10 years straight; and not a single one had done it for 15 years in a row. An academic study of thousands of U.S. stocks from 1951 through 1998 found that over all 10-year periods, net earnings grew by an average of 9.7% annually. But for the biggest 20% of companies, earnings grew by an annual average of just 9.3%. Even many corporate leaders fail to understand these odds.

- The intelligent investor, however, gets interested in big growth stocks not when they are at their most popular-but when something goes wrong.

- So how many of the Forbes 400 fortunes from 1982 remained on the list 20 years later? Only 64 of the original members-a measly 16%-were still on the list in 2002.

- To see whether a stock is selling for less than the value of net working capital (what Graham's followers call "net nets"), download or request the most recent quarterly or annual report from the company's website or from the EDGAR database at www.sec.gov. From the company's current assets, subtract its total liabilities, including any preferred stock and long-term debt.

- It's not that you should never invest in foreign markets like Japan; it's that the Japanese should never have kept all their money at home. And neither should you. Putting up to a third of your stock money in mutual funds that hold foreign stocks (including those in emerging markets) helps insure against the risk that our own backyard may not always be the best place in the world to invest.

- It is easy for us to tell you not to speculate; the hard thing will be for you to follow this advice.

- Since common stocks, even of investment grade, are subject to recurrent and wide fluctuations in their prices, the intelligent investor should be interested in the possibilities of profiting from these pendulum swings. There are two possible ways by which he may try to do this: the way of timing and the way of pricing. By timing we mean the endeavor to anticipate the action of the stock market — to buy or hold when the future course is deemed to be upward, to sell or refrain from buying when the course is downward. By pricing we mean the endeavor to buy stocks when they are quoted below their fair value and to sell them when they rise above such value. A less ambitious form of pricing is the simple effort to make sure that when you buy you do not pay too much for your stocks. This may suffice for the defensive investor, whose emphasis is on long-pull holding; but as such it represents an essential minimum of attention to market levels.

- Between 1897 and 1949 there were ten complete market cycles, running from bear-market low to bull-market high and back to bear-market low. Six of these took no longer than four years; four ran for six or seven years, and one — the famous "new-era" cycle of 1921-1932 — lasted eleven years. The percentage of advance from the lows to highs ranged from 44% to 500%, with most between about 50% and 100%. The percentage of subsequent declines ranged from 24% to 89%, with most found between 40% and 50%. (It should be remembered that a decline of 50% fully offsets a preceding advance of 100%.)

- Nearly all the bull markets had a number of well-defined characteristics in common, such as (1) a historically high price level, (2) high price/ earnings ratios, (3) low dividend yields as against bond yields, (4) much speculation on margin, and (5) many offerings of new common-stock issues of poor quality.

- All things excellent are as difficult as they are rare.

- It is not just possible, but probable, that most of the stocks you own will gain at least 50% from their lowest price and lose at least 33% from their highest price-regardless of which stocks you own or whether the market as a whole goes up or down. If you can't live with that-or you think your portfolio is somehow magically exempt from it-then you are not yet entitled to call yourself an investor. (Graham refers to a 33% decline as the "equivalent one-third" because a 50% gain takes a $10 stock to $15. From $15, a 33% loss [or $5 drop] takes it right back to $10, where it started.)

- It is for these reasons of human nature, even more than by calculation of financial gain or loss, that we favor some kind of mechanical method for varying the proportion of bonds to stocks in the investor's portfolio. The chief advantage, perhaps, is that such a formula will give him something to do. As the market advances he will from time to time make sales out of his stockholdings, putting the proceeds into bonds; as it declines he will reverse the procedure. These activities will provide some outlet for his otherwise too-pent-up energies. If he is the right kind of investor he will take added satisfaction from the thought that his operations are exactly opposite from those of the crowd

- The better a company's record and prospects, the less relationship the price of its shares will have to their book value. But the greater the premium above book value, the less certain the basis of determining its intrinsic value — i.e., the more this "value" will depend on the changing moods and measurements of the stock market. Thus we reach the final paradox, that the more successful the company, the greater are likely to be the fluctuations in the price of its shares. This really means that, in a very real sense, the better the quality of a common stock, the more speculative it is likely to be — at least as compared with the unspectacular middle-grade issues.

- These striking losses did not indicate any doubt about the future long-term growth of IBM or Xerox; they reflected instead a lack of confidence in the premium valuation that the stock market itself had placed on these excellent prospects

- A stock does not become a sound investment merely because it can be bought at close to its asset value. The investor should demand, in addition, a satisfactory ratio of earnings to price, a sufficiently strong financial position, and the prospect that its earnings will at least be maintained over the years.

- We see in this history how wide can be the vicissitudes of a major American enterprise in little more than a single generation, and also with what miscalculations and excesses of optimism and pessimism the public has valued its shares.

- There are two chief morals to this story. The first is that the stock market often goes far wrong, and sometimes an alert and courageous investor can take advantage of its patent errors. The other is that most businesses change in character and quality over the years, sometimes for the better, perhaps more often for the worse. The investor need not watch his companies' performance like a hawk; but he should give it a good, hard look from time to time.

- The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell

- As in all other activities that emphasize price movements first and underlying values second, the work of many intelligent minds constantly engaged in this field tends to be self-neutralizing and self-defeating over the years.

- The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored. He should never buy a stock because it has gone up or sell one because it has gone down. He would not be far wrong if this motto read more simply: "Never buy a stock immediately after a substantial rise or sell one immediately after a substantial drop."

- Nothing important on Wall Street can be counted on to occur exactly in the same way as it happened before.

- The price fluctuations of convertible bonds and preferred stocks are the resultant of three different factors: (1) variations in the price of the related common stock, (2) variations in the credit standing of the company, and (3) variations in general interest rates.

- The happiness of those who want to be popular depends on others; the happiness of those who seek pleasure fluctuates with moods outside their control; but the happiness of the wise grows out of their own free acts. -Marcus Aurelius

- The manic-depressive Mr. Market does not always price stocks the way an appraiser or a private buyer would value a business. Instead, when stocks are going up, he happily pays more than their objective value; and, when they are going down, he is desperate to dump them for less than their true worth. Would you willingly allow a certifiable lunatic to come by at least five times a week to tell you that you should feel exactly the way he feels? Would you ever agree to be euphoric just because he is-or miserable just because he thinks you should be? Of course not. You'd insist on your right to take control of your own emotional life, based on your experiences and your beliefs. But, when it comes to their financial lives, millions of people let Mr. Market tell them how to feel and what to do-despite the obvious fact that, from time to time, he can get nuttier than a fruitcake

- The cheaper stocks got, the less eager people became to buy them-because they were imitating Mr. Market, instead of thinking for themselves

- The intelligent investor shouldn't ignore Mr. Market entirely. Instead, you should do business with him-but only to the extent that it serves your interests. Mr. Market's job is to provide you with prices; your job is to decide whether it is to your advantage to act on them. You do not have to trade with him just because he constantly begs you to.

- One of Graham's most powerful insights is this: "The investor who permits him to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage." What does Graham mean by those words "basic advantage"? He means that the intelligent individual investor has the full freedom to choose whether or not to follow Mr. Market. You have the luxury of being able to think for yourself.

- With billions of dollars under management, they must gravitate toward the biggest stocks-the only ones they can buy in the multimillion-dollar quantities they need to fill their portfolios. Thus many funds end up owning the same few overpriced giants. Investors tend to pour more money into funds as the market rises. The managers use that new cash to buy more of the stocks they already own, driving prices to even more dangerous heights. If fund investors ask for their money back when the market drops, the managers may need to sell stocks to cash them out. Many portfolio managers get bonuses for beating the market, so they obsessively measure their returns against benchmarks like the S&P 500 index. So there's no reason you can't do as well as the pros. What you cannot do (despite all the pundits who say you can) is to "beat the pros at their own game." The pros can't even win their own game! Why should you want to play it at all? If you follow their rules, you will lose-since you will end up as much a slave to Mr. Market as the professionals are.

- But investing isn't about beating others at their game. It's about controlling yourself at your own game.

- If you investment horizon is long-at least 25 or 30 years-there is only one sensible approach: Buy every month, automatically, and whenever else you can spare some money. The single best choice for this lifelong holding is a total stock-market index fund. Sell only when you need the cash

- Groundbreaking new research in neuroscience shows that our brains are designed to perceive trends even where they might not exist

- The brilliant psychologists Daniel Kahneman and Amos Tversky have shown that the pain of financial loss is more than twice as intense as the pleasure of an equivalent gain

- Paradoxically, "you will be much more in control," explains neuroscientist Antonio Damasio, "if you realize how much you are not in control." By acknowledging your biological tendency to buy high and sell low, you can admit the need to dollar-cost average, rebalance, and sign an investment contract. By putting much of your portfolio on permanent autopilot, you can fight the prediction addiction, focus on your long-term financial goals, and tune out Mr. Market's mood swings.

- Investors who received frequent news updates on their stocks earned half the returns of investors who got no news at all.

- You could have done what most people do-either whine about your loss, or sweep it under the rug and pretend it never happened. Or you could have taken control. Before 2002 ended, you could have sold all your Coke shares, locking in the $3,200 loss. Then, after waiting 31 days to comply with IRS rules, you would buy 200 shares of Coke all over again. The result: You would be able to reduce your tax- able income by $3,000 in 2002, and you could use the remaining $200 loss to offset your income in 2003. And better yet, you would still own a company whose future you believe in-but now you would own it for almost one-third less than you paid the first time. With Uncle Sam subsidizing your losses, it can make sense to sell and lock in a loss. If Uncle Sam wants to make Mr. Market look logical by comparison, who are we to complain?

- They have promoted good habits of savings and investment; they have protected countless individuals against costly mistakes in the stock market; they have brought their participants income and profits commensurate with the overall returns from common stocks. On a comparative basis we would hazard the guess that the average individual who put his money exclusively in investment-fund shares in the past ten years has fared better than the average person who made his common-stock purchases directly.

- For periods as long as 10 years, the returns of the Dow and the S&P 500 can diverge by fairly wide margins. Over the course of the typical investing lifetime, however-say 25 to 50 years-their returns have tended to converge quite closely.

- Intriguingly, the disastrous boom and bust of 1999-2002 also came roughly 35 years after the previous cycle of insanity. Perhaps it takes about 35 years for the investors who remember the last "New Economy" craze to become less influential than those who do not. If this intuition is correct, the intelligent investor should be particularly vigilant around the year 2030.

- There have been instances of funds that have consistently outperformed the market averages for, say, ten years or more. But these have been scarce exceptions, having most of their operations in specialized fields, with self-imposed limits on the capital employed — and not actively sold to the public

- Unfortunately, in the financial markets, luck is more important than skill. If a manager happens to be in the right corner of the market at just the right time, he will look brilliant— but all too often, what was hot suddenly goes cold and the manager's IQ seems to shrivel by 50 points

- This is yet another reminder that the market's hottest market sector-in 1999 that was technology-often turns as cold as liquid nitrogen, with blinding speed and utterly no warning. And it's a reminder that buying funds based purely on their past performance is one of the stupidest things an investor can do. Financial scholars have been studying mutual-fund performance for at least a half century, and they are virtually unanimous on several points: the average fund does not pick stocks well enough to overcome its costs of researching and trading them; the higher a fund's expenses, the lower its returns; the more frequently a fund trades its stocks, the less it tends to earn; highly volatile funds, which bounce up and down more than average, are likely to stay volatile; funds with high past returns are unlikely to remain winners for long.

- Sector funds specializing in almost every imaginable industry are available-and date back to the 1920s. After nearly 80 years of history, the evidence is overwhelming: The most lucrative, and thus most popular, sector of any given year often turns out to be among the worst performers of the following year. There's a second lesson here: To succeed, the individual investor must either avoid shopping from the same list of favorite stocks that have already been picked over by the giant institutions, or own them far more patiently.

- Management funds should be the biggest shareholders of their funds, should be cheap, different, shut the door when get enough money, don’t advertise, and look at past performance, remembering that it is only a pale predictor of future returns

- The Sequoia Fund underperformed the S & P 500 index in 12 out of its 29 years-or more than 41% of the time. Yet Sequoia gained more than 12,500% over that period, versus 4,900% for the index

- So when should you sell? Here a few definite red flags: a sharp and unexpected change in strategy, such as a "value" fund loading up on technology stocks in 1999 or a "growth" fund buying tons of insurance stocks in 2002; an increase in expenses, suggesting that the managers are lining their own pockets; large and frequent tax bills generated by excessive trading; suddenly erratic returns, as when a formerly conservative fund generates a big loss (or even produces a giant gain). If you're not prepared to stick with a fund through at least three lean years, you shouldn't buy it in the first place.

- This is their general view that a stock should be bought if the near-term prospects of the business are favorable and should be sold if these are unfavorable — regardless of the current price. Such a superficial principle often prevents the services from doing the sound analytical job of which their staffs are capable — namely to ascertain whether a given stock appears over- or undervalued at the current price in the light of its indicated long-term future earning power.

- The intelligent investor will not do his buying and selling solely on the basis of recommendations received from a financial service. Once this point is established, the role of the financial service then becomes the useful one of supplying information and offering suggestions.

- Here are some of the questions that prominent financial planners recommended any prospective client should ask: Why are you in this business? What is the mission statement of your firm? Besides your alarm clock, what makes you get up in the morning? What is your investing philosophy? Do you use stocks or mutual funds? Do you use technical analysis? Do you use market timing? (A "yes" to either of the last two questions is a "no" signal to you.) Do you focus solely on asset management, or do you also advice on taxes, estate and retirement planning, budgeting and debt management, and insurance? How do your education, experience, and credentials qualify you to give those kinds of financial advice? What needs do your clients typically have in common? How can you help me achieve my goals? How will you track and report my progress? Do you provide a checklist that I can use to monitor the implementation of any financial plan we develop?

- If you have less than $100,000 to invest, you may not be able to find a financial adviser who will take your account. In that case, buy a diversified basket of low-cost index funds, follow the behavioral advice throughout this book, and your portfolio should eventually grow to the level at which you can afford an adviser.

- If the adviser is a line of defense between you and your worst impulsive tendencies, then he or she should have systems in place that will help the two of you control them." Among those systems: a comprehensive financial plan that outlines how you will earn, save, spend, borrow, and invest your money; an investment policy statement that spells out your fundamental approach to investing; an asset-allocation plan that details how much money you will keep in different investment categories. These are the building blocks on which good financial decisions must be founded, and they should be created mutually-by you and the adviser-rather than imposed unilaterally. You should not invest a dollar or make a decision until you are satisfied that these foundations are in place and in accordance with your wishes.

- For the more dependent the valuation becomes on anticipations of the future — and the less it is tied to a figure demonstrated by past performance — the more vulnerable it becomes to possible miscalculation and serious error.

- Most of the writing of security analysts on formal appraisals relates to the valuation of growth stocks. Our study of the various methods has led us to suggest a foreshortened and quite simple formula for the valuation of growth stocks, which is intended to produce figures fairly close to those resulting from the more refined mathematical calculations. Our formula is: Value = Current (Normal) Earnings X (8.5 plus twice the expected annual growth rate). The growth figure should be that expected over the next seven to ten years

- Eventually the intelligent analyst will confine himself to those groups in which the future appears reasonably predictable, or where the margin of safety of past-performance value over current price is so large that he can take his chances on future variations — as he does in selecting well-secured senior securities. These industry groups, ideally, would not be overly dependent on such unforeseeable factors as fluctuating interest rates or the future direction of prices for raw materials like oil or metals. Possibilities might be industries like gaming, cosmetics, alcoholic beverages, nursing homes, or waste management

- Graham feels that five elements are decisive [when deciding which companies to invest in]. He summarizes them as:

- The company's "general long-term prospects" – moat, marathoner, sows and reaps (R&D)

- The quality of its management

- Its financial strength and capital structure – generates more cash than it consumes and puts that cash to productive use

- Its dividend record

- Its current dividend rate.

- Don't take a single year's earnings seriously and if you do pay attention to short-term earnings, look out for booby traps in the per-share figures. If our first warning were followed strictly the second would be unnecessary. But it is too much to expect that most shareholders can relate all their common-stock decisions to the long-term record and the long-term prospects.

- Recent history-and a mountain of financial research-have shown that the market is unkindest to rapidly growing companies that suddenly report a fall in earnings. Thus, one of the biggest risks in owning growth stocks is not that their growth will stop, but merely that it will slow down. And in the long run, that is not merely a risk, but a virtual certainty

- In short, pro forma earnings enable companies to show how well they might have done if they hadn't done as badly as they did. As an intelligent investor, the only thing you should do with pro forma earnings is ignore them.

- A few pointers will help you avoid buying a stock that turns out to be an accounting time bomb:

- Read backwards. When you research a company's financial reports, start reading on the last page and slowly work your way toward the front. Anything that the company doesn't want you to find is buried in the back-which is precisely why you should look there first.

- Read the notes. Never buy a stock without reading the footnotes to the financial statements in the annual report. Usually labeled "summary of significant accounting policies," one key note describes how the company recognizes revenue, records inventories, treats installment or contract sales, expenses its marketing costs, and accounts for the other major aspects of its business. In the other footnotes, watch for disclosures about debt, stock options, loans to customers, reserves against losses, and other "risk factors" that can take a big chomp out of earnings. Among the things that should make your antennae twitch are technical terms like "capitalized," "deferred," and "restructuring"-and plain-English words signaling that the company has altered its accounting practices, like "began," "change," and "however."

- Today, companies should adhere to these qualities:

- Adequate size - ~$2B today

- A sufficiently strong financial condition – Current ratio less than or equal to 2

- Continued dividends for at least the past 20 years.

- No earnings deficit in the past 10 years.

- 10 year growth of at least one-third in per-share earnings.

- Price no more than 15 times average earnings of the past 3 years.

- Moderate P/E ratio - Graham recommends limiting yourself to stocks whose current price is no more than 15 times average earnings over the past three years. Incredibly, the prevailing practice on Wall Street today is to value stocks by dividing their current price by something called "next year's earnings." That gives what is sometimes called "the forward P/E ratio." But it's nonsensical to derive a price/earnings ratio by dividing the known current price by unknown future earnings.

- Anything company with over 60% institutional ownership suggests that a stock is scarcely undiscovered and probably "overowned." (When big institutions sell, they tend to move in lockstep, with disastrous results for the stock.

- If you are not willing to go to the minimal effort of reading the proxy and making basic comparisons of financial health across five years' worth of annual reports, then you are too defensive to be buying individual stocks at all. Get yourself out of the stock-picking business and into an index fund, where you belong.

- In Graham's terms, a large amount of goodwill can result from two causes: a corporation can acquire other companies for substantially more than the value of their assets, or its own stock can trade for substantially more than its book value.

- His second choice would be to apply a set of standards to each purchase, to make sure that he obtains (1) a minimum of quality in the past performance and current financial position of the company, and also (2) a minimum of quantity in terms of earnings and assets per dollar of price. At the close of the previous chapter we listed seven such quality and quantity criteria suggested for the selection of specific common stocks. Let us describe them in order.

- In a remarkable confirmation of Graham's point, the dull-sounding Standard & Poor's Utility Index outperformed the vaunted NASDAQ Composite Index for the 30 years ending December 31 , 2002.

- For most people, investing on the basis of protection from overpaying for a stock and from overconfidence in the quality of their own judgment-is the best solution.

- By contrast, those who emphasize protection are always especially concerned with the price of the issue at the time of study. Their main effort is to assure themselves of a substantial margin of safety indicated present value above the market price — which margin could absorb unfavorable developments in the future. Generally speaking, therefore, it is not so necessary for them to be enthusiastic over the company's long-run prospects as it is to be reasonably confident that the enterprise will get along

- Let him emphasize diversification more than individual selection. Incidentally, the universally accepted idea of diversification is, in part at least, the negation of the ambitious pretensions of selectivity

- Keep 90% of your stock money in an index fund, leaving 10°/o with which to try picking your own stocks. Only after you build that solid core should you explore.

- It is easy in the world to live after the world's opinion; it is easy in solitude to live after our own; but the great man is he who in the midst of the crowd keeps with perfect sweetness the independence of solitude. -Ralph Waldo Emerson

- Graham advised investors to practice first, just as even the greatest athletes and musicians practice and rehearse before every actual performance. He suggested starting off by spending a year tracking and picking stocks (but not with real money). If you enjoyed the experiment and earned sufficiently good returns, gradually assemble a basket of stocks-but limit it to a maximum of 10% of your overall portfolio (keep the rest in an index fund). And remember, you can always stop if it no longer interests you or your returns turn bad.

- From EPS to ROIC (owner earnings)

- Net income or earnings per share (EPS) has been distorted in recent years by factors like stock-option grants and accounting gains and charges. To see how much a company is truly earning on the capital it deploys in its businesses, look beyond EPS to ROIC, or return on invested capital. ROIC = Owner Earnings- Invested Capital, where Owner Earnings is equal to:

- Operating profit

- plus depreciation

- plus amortization of goodwill

- minus Federal income tax (paid at the company's average rate)

- minus cost of stock options

- minus "maintenance" (or essential) capital expenditures

- minus any income generated by unsustainable rates of return on pension funds (as of 2003, anything greater than 6.5%) and where Invested Capital is equal to:

- Total assets minus cash (as well as short-term investments and non-interest bearing current liabilities) plus past accounting charges that reduced invested capital.

- ROIC has the virtue of showing, after all legitimate expenses what the company earns from its operating businesses-and how efficiently it has used the shareholders' money to generate that return. An ROIC of at least 10% is attractive; even 6% or 7% can be tempting if the company has good brand names, focused management, or is under a temporary cloud.

- Look for companies that limit issuance of stock options to roughly 3°/o of shares outstanding.

- One technique that can be helpful: See which leading professional money managers own the same stocks you do. If one or two names keep turning up, go to the websites of those fund companies and download their most recent reports. By seeing which other stocks these investors own, you can learn more about what qualities they have in common; by reading the managers' commentary, you may get ideas on how to improve your own approach.

- No matter which techniques they use in picking stocks, successful investing professionals have two things in common: First, they are disciplined and consistent, refusing to change their approach even when it is unfashionable. Second, they think a great deal about what they do and how to do it, but they pay very little attention to what the market is doing.

- Warren's Way