“A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of ‘exit.’ The only essential thing is growth. Everything else we associate with startups follows from growth. To grow rapidly, you need to make something you can sell to a big market. That’s the difference between Google and a barbershop. A barbershop doesn’t scale.” Paul Graham

“A startup is a temporary organization designed to search for a repeatable and scalable business model.” Steve Blank

There are many definitions of scalability and ways in which the term can be used. For example, in a technical setting, one definition of scalability is: “a measure of the ability of a system to maintain its performance under an increasing load.” In a business setting, the definitions of scalability can vary based on context. Business people who focus on management issues tend to look at scalability differently than people who are financially-oriented. A sales team looks at scalability in yet another way. A CFO might argue that scalability as the ability of the business to grow revenue and profit at an exponential rate while only adding resources at an incremental rate. Some venture capitalists argue that scalability is not present unless the business has the ability to grow revenue to $100 million or more which can justify a venture capital investment.

Given the diversity of views about the definition of scalability, perhaps it is best thought of as a phenomena where “you know it when you see it.” If that is true, what would an optimally scalable business look like? Or instead, what qualities increase the scalability of a business? The remainder of this blog post is a discussion of a dozen attributes which can potentially make a business more scalable. As you read this blog post you may conclude, like I have, that these attributes of scalability are in many cases essentially our old friends from the unit economics equation (CAC, ARPU, Churn, Gross Margin and cost of money) plus free cash flow and some outside frictional forces like government regulation and the laws of physics. You may also conclude, as I have, that no two businesses are exactly alike when it comes to scalability. Each of the attributes of scalability are always in flux, with changes in any one attribute potentially impacting the others. There is no precise formula or recipe that will enable a business to scale, but there are best practices. Every business faces different scaling challenges and opportunities.

Scalable businesses tend to have these twelve attributes:

- Customer acquisition cost (CAC) is low in a scalable business since positive word of mouth is strong (i.e., the business benefits from organic customer acquisition)

Andy Rachleff believes: “If you don’t have exponential word of mouth growth, you don’t have product/market fit.” In terms of staging a successful startup, product/market fit (which is central to the value hypothesis) should precede scaling (which is central to the growth hypothesis). Spending capital on growth before you have a product that people want to buy is essentially a giant bonfire of cash. Steve Blank talks about why scalability is so important in business: “Success isn’t about size – of team or funding. It turns out premature scaling is the leading cause of hemorrhaging cash in a startup – and death. In fact: (1) The team size of startups that scale prematurely is 3 times bigger than the consistent startups at the same stage; (2) 74% of high growth Internet startups fail due to premature scaling; (3) Startups that scale properly grow about 20 times faster than startups that scale prematurely; and (4) 93% of startups that scale prematurely never break the $100k revenue per month threshold.” Ryan Smith the founder of Qualtrics describes this objective simply: “Nail It, Then Scale It.” Too often people try to scale a start-up before they nail it.

The positive customer word of mouth that Rachleff describes is important for a business since it enables a lower customer acquisition cost (CAC). In other words, scalable businesses generating organic growth do not need massive spending on marketing and sales. Every business will have some customer acquisition costs but in the best and most scalable business that cost is relatively low. Bill Gurley agrees with Rachleff: “With great companies the consumers buy because the product is so good. They aren’t spending [tens of millions] on marketing.” Gurley also believes that customers quality if higher is they are organically acquired: “Organic users typically have a higher NPV, a higher conversion rate, a lower churn, and more satisfied than customers acquired through marketing spend.”

It is important to understand that growth is not always organic from the start of a business. Sometimes critical mass must be achieved in non-scalable ways before a business becomes scalable via organic customer acquisition. Paul Graham points out that sometimes doing what does not scale is essential to enabling critical mass which does allow a business to scale: “One of the most common types of advice we give at Y Combinator is to do things that don’t scale. In Airbnb’s case, these consisted of going door to door in New York, recruiting new users and helping existing ones improve their listings.”

2. Scalable businesses have fewer incremental marginal costs after a modest upfront investment has been made to create the product or service

Software is the ultimate representation of this second attribute of scalability because it has unique qualities. If you give me your car, you no longer have a car. But if you give me a copy of your software, you still have your software. We don’t necessarily need to be “rivals” about owning the same software, so the term used to describe something like software is “non-rival.” That billions of people can possess the same software at close to zero additional cost on a non-rival basis, combined with the fact that cost of making another copy of software is essentially zero and the cost of distributing that software to customers is also close to zero means that a software business when properly run and possessing the right attributes can deliver almost magical business results. Bill Gates said about the software business in 1993: “It’s all about scale economics and market share. When you’re shipping a million units of Windows software a month, you can afford to spend $300 million a year improving it and still sell it at a low price.” Once a software business recovers its cost associated with research and development a lion’s share of the additional revenue can drop to the bottom line as profit. The profit potential of software is unprecedented in the history of business. The business outcomes that Google and Facebook represent are examples of this phenomenon. Contrast the scalability of a software business with a home security company that must roll a truck with a trained technician who installs expensive equipment in the home and where a human operator must respond to service calls.

3. A business is more scalable if the total addressable market is enormous

It is by definition impossible to grow a business significantly if the market is too small. Sequoia’s co-founder Don Valentine said once: “We have always focused on the market — the size of the market, the dynamics of the market, the nature of the competition — because our objective always was to build big companies. If you don’t attack a big market, it’s highly unlikely you’re ever going to build a big company.” One slide that venture capitalists almost always see in a pitch deck for a startup is the addressable market slide. Often it is a pie chart depicting a massive total addressable market (TAM) and conveying the point that the business only needs a small slice of that market to be a huge success. For example, here below is a company called Artsy making a case for a large addressable market for its business:

“Despite an estimated $3 trillion of art assets in the world, only $44 billion trades in a given year—and less than 2 percent of qualified buyers participate in this market due to high transaction costs, long lead times, and limited transparency on pricing and value,’ Artsy will bring this last major consumer category online and thereby substantially expand the size of the global art market. We look forward to working with Artsy to make a larger, more connected art market a reality. The global art market is currently valued at around $44 billion annually, and about $3.75 billion of that was spent online in 2016, according to The European Fine Art Foundation, a rise of about 15 percent over 2015.”

4. In a scalable business the average cost of creating the products and/or services fall as the volume of its output increases (economies of scale)

Supply-side economies of scale exist when there are reductions in the average cost per unit associated with increasing the scale of production for a product or service. JP Morgan’s Jamie Dimon has said that if we didn’t have economies of scale, “We’d still be living in tents and eating buffalo.” Scale economies have always been important but n recent decades scale economies and their impact have been put on the equivalent of steroids. Erik Brynjolfsson explains this phenomenon: “Technology has made it easier for different firms to coordinate their activities with one another, and they don’t have to be part of one company. They can get the benefits of scale without the inertia of scale.”

Scalabilty can be further understood by sorting the attributes of scalability into categories. Venture capitalist Alex Taussig describes the financial aspects of scalability in this way: “Businesses that scale are businesses with operating leverage. Put simply, if you add operating costs (sales, marketing, administrators, R&D, etc.) at the same rate you grow revenue, then your business does not scale. Alternatively, if additional revenue requires relatively smaller and smaller additions to operating costs, then congratulations… your business scales!”

5. A scalable business requires fewer people to operate

Mike Maples Jr. describes some of the operational aspects of scalability here:

“Company power has to do with technical debt or management debt. So technical debt is sort of like when you make short-term, expedient decisions in the technology that sort cost you later. Maybe in order to ship something on time, you had to cut some corners, and the architecture wasn’t as elegant as it could’ve been, or just the attention to detail or bug fixing maybe wasn’t as good as it could’ve been. And so technical debt is sort of like when you put off some things that you have to solve later, but they cost you more money and time after the fact. And management debt is the same thing, but it’s for lack of having management systems in place. And if you have too much management debt, if the company starts to take off and do really well, you don’t have the internal capacity and wherewithal to scale to the speed that the opportunity might scale.”

Maples uses this approach to looking at a business opportunity which I have written about before:

Fred Wilson describes some of the work required to enable operational scalability in this way: “Investing in management means building communication systems, business processes, feedback, and routines that let you scale the business and team as efficiently as possible.”

The classic example of a non-scalable business is a consulting company since in order for the business to grow it must hire more people the same skills and abilities. Alex Taussig writes: “McKinsey & Co. is one of the greatest consulting firms and brands in corporate America. But, it doesn’t scale. Ignoring its publishing business, McKinsey needs to add consultants, almost on a one-to-one basis, to grow its revenue.” It is time consuming and expensive to create new consultants and they often leave to form their own consulting firms or join a company.

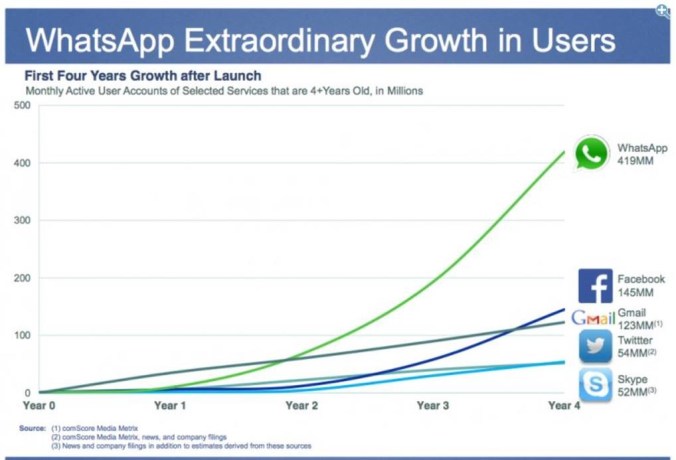

Other business scale very well. It is hard to find a more representative story of the ability of a software-driven business to swiftly rise to fabulous success while employing very few people than the messaging provider WhatsApp, a business famously sold to Facebook for $21.8 billion. The company was founded in 2009 and sold just a few years later in 2014. Wired magazine points out: “One of the (many) intriguing parts of the WhatsApp story is that it has achieved such enormous scale with such a tiny team. When the company was acquired by Facebook, it had 35 engineers and reached more than [one billion] users.” New approaches to programming adopted by WhatsApp enabled scale to be created by the business at speeds that were previously not possible. WhatsApp, Skype, Line and WeChat now dominate messaging, saving consumers billions of dollars in charges.

6. A business that generates positive float, which creates a low cost source of capital, is more scalable

Bill Gurley and Jane Hodges describe the Dell strategy in a classic article from 1998:

“From a corporate perspective, the best measure of fitness is return on invested capital (ROIC). This measure matters most because over the long haul, capital flows toward investment opportunities with a high ROIC. Inefficient companies, on the other hand, are eventually starved of the cash they need to survive. To understand just how indispensable technology has become, you have to follow the basic math of return on invested capital. To get ROIC, you divide EBIT, or earnings before interest and taxes, by invested capital. Now let’s divide the numerator and the denominator by annual sales. This restates ROIC as operating margin multiplied by asset turnover. In other words, the two components that define a company’s fitness are the ability to charge a high spread between price and actual cost, and the ability to generate sales from a small base of invested capital…. companies that lack competitive information technology will be in serious trouble. They will resemble a 40-year-old trying to win Wimbledon with a small wooden racquet. Their business models may no longer be economically sustainable. Companies like Dell have reached an interesting new stage in the evolution of business–negative working capital. They collect money from customers before they have to acquire components or spend money. This phenomenon allows these companies to grow without raising capital, even if day-to-day profitability is zero.”

Gurley elaborated on Dell’s advantage in another article: “Dell’s incredible five days of inventory allows it to pass on component price declines faster than anyone else in the industry. But perhaps the unique aspect of Dell’s business advantage is its negative cash conversion cycle. Because it keeps only five days of inventories, manages receivables to 30 days, and pushes payables out to 59 days, the Dell model will generate cash–even if the company were to report no profit whatsoever.”

Justin Fox explained the financial benefits further:

“If you have a business where your customers pay you quickly, you manage your inventory well, and you’re able to take your time in paying your suppliers, your free cash flow can be consistently positive even when your net income is not. Which is exactly the kind of business that Jeff Bezos and his colleagues have constructed at Amazon over the past decade. According to my instructor in such matters, Harvard Business School finance professor Mihir Desai, the key metric of a company’s cash-generating prowess is the cash conversion cycle, which is days of inventory plus days sales outstanding (how long it takes your customers to pay you, basically), minus how many days it takes you to pay your suppliers. Super-efficient retailers such as Walmart and Costco have been able to bring their CCC down to the single digits. That’s impressive. But at Amazon last year, the CCC was negative 30.6 days.”

7. In a scalable business pricing power is high, enabling high gross margins and profit

Warren Buffett believes: “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.” Charlie Munger has a similar view:

“There are actually businesses, that you will find a few times in a lifetime, where any manager could raise the return enormously just by raising prices—and yet they haven’t done it. So they have huge untapped pricing power that they’re not using. That is the ultimate no-brainer. … Disney found that it could raise those prices a lot and the attendance stayed right up. So a lot of the great record of Eisner and Wells … came from just raising prices at Disneyland and Disneyworld and through video cassette sales of classic animated movies… At Berkshire Hathaway, Warren and I raised the prices of See’s Candy a little faster than others might have. And, of course, we invested in Coca-Cola—which had some untapped pricing power. And it also had brilliant management. So a Goizueta and Keough could do much more than raise prices. It was perfect.”

What companies have pricing power today? Facebook would be one example. In the most recent quarter the average growth in the price of Facebook advertising grew by 24 percent to a record high. What drives pricing power? The sustainable competitive advantage that I wrote about in my blog post on Michael Porter.

8. A business is more scalable if it has few regulatory and legal barriers

Some businesses require approval after approval to grow revenue and profit and are not very scalable. Highly regulated businesses are harder to scale. One highly regulated business that I have experience with is communications satellites. Not only do you need permission to launch satellites but you need agreement of regulators that you can occupy a spot in orbit. use radio frequencies in creating communications links and to operate as a communications provider.

Many other industries have a high regulatory component to their business. The bad new is that businesses with a lot of regulation impacting what they do are hard and expensive businesses to enter. The good news is the same thing, since that difficulty can create barriers to entry.

9. If product and/or service distribution simple and inexpensive (preferably just bits delivered on-line) the product is more scalable

The speed of adoption of a service like WhatsApp has no precedent in the history of business. The cost of delivering bits for that application is tiny. People receive the product on devices that they already paid for. When a business has attributes like WhatsApp the result can be remarkable:

Chris Dixon has said that it is only a matter of time before a single programmer achieves greater success than WhatsApp in terms of how fast his or her application is adopted. Now, more than ever, one person can literally change the world in a major way since they now have the ability to create software on inexpensive machines, using techniques they can learn on line, by accessing a third party data center in the cloud and delivering the service over the global network of networks. The good news is that barriers to entry in business are disappearing. The bad news is also that barriers to entry are disappearing in business.

10. Maintenance and support costs are low in a scalable business

Many modern software applications can be supported in an automated way, which can make the cost of goods sold (COGS) remarkably low and gross margins incredibly attractive. I wrote about that phenomenon in my blog post on pricing and gross margins. Cloud computing has radically reduced the cost of creating a startup. The good news is that it is cheaper than ever to conduct new business experiments, the bad news is that there are more people and companies than ever conducting these experiments.

11. In a scalable business customer retention is very high (low churn)

My blog post on customer churn is here https://25iq.com/2017/01/27/everyone-poops-and-has-customer-churn-and-a-dozen-notes/ and since this post is already getting a bit long I will not say much more here. What makes a business scalable is a service that is sticky and as a result does not suffer too much from painful churn. Every business has some customer churn, but some have less than others. The best businesses understand the value of customer retention and as a result have effective ways to keep the impact of churn manageable.

12. In a scalable business network effects are strong, which increases the value of the product or service as the number of customers grows

My post on network effects is here https://25iq.com/2016/03/24/two-powerful-mental-models-network-effects-and-critical-mass/ and again I won’t write too much more now since this post is running long.

I will add one final note before concluding this post. Investors should consider both supply-side and demand side scalability in evaluating the financial prospects of a business. Supply-side scalability concerns the ability of a business to use capital, labor and resources more efficiently as the business grows. Managers concerned with supply-side scale are working to optimize processes so profit can be maximized. Sangeet Paul Choudary writes:

“Optimization involves creating repeatable processes which can be cost-effectively repeated over and over again to grow the business. The two key aspects of scaling are:

A) Repeatability

B) Cost-effectiveness

A lot of business education is focused on strategies for optimization of these processes. An IT outsourcing shop, for example, optimizes processes surrounding the labor variable to create scale. A manufacturing business has to optimize processes involving procurement, production, distribution.”

Scalability on the demand side, which is where network effects happen, can be created by structuring how customers interact with the product and with other users of the product.

Network effects exist when the “value” of a format or system depends on the number of users. These effects can be positive (for example, a telephone network) or negative (for example, congestion). They can also be direct (increases in usage lead to direct increases in value to users, as with the telephone) or indirect (usage increases the production of complementary goods, as with cases for mobile phones).

Investors seek a business with network effects since it has attributes which can help it build a barriers to entry against competitors.

Notes:

https://steveblank.com/2010/01/25/whats-a-startup-first-principles/

https://steveblank.com/2010/01/14/a-startup-is-not-a-smaller-version-of-a-large-company/

http://fortune.com/2011/06/01/how-to-know-if-your-business-will-scale/

http://abovethecrowd.com/2012/09/04/the-dangerous-seduction-of-the-lifetime-value-ltv-formula/

https://www.brookings.edu/wp-content/uploads/1990/01/1990_bpeamicro_romer.pdf

http://natishalom.typepad.com/nati_shaloms_blog/2007/07/the-true-meanin.html

http://www.linfo.org/scalable.html

https://brandcave.co/blog/the-weird-relationship-between-startups-and-scalability/

http://platformed.info/the-scalable-startup-test-bumps-vs-engines/

https://blogs.wsj.com/accelerators/2013/05/30/ryan-smith-nail-it-then-scale-it/

- What Would a Healthy Music Streaming Business (e.g., Spotify, SoundCloud, Pandora) Look Like?

- A Dozen Lessons about Investing and Money from Dan Ariely

Categories: Uncategorized